Question: no more info Question 3: Total 25 marks Bravo Ltd (UK) wishes to fund an expansion in its business and has the option to borrow

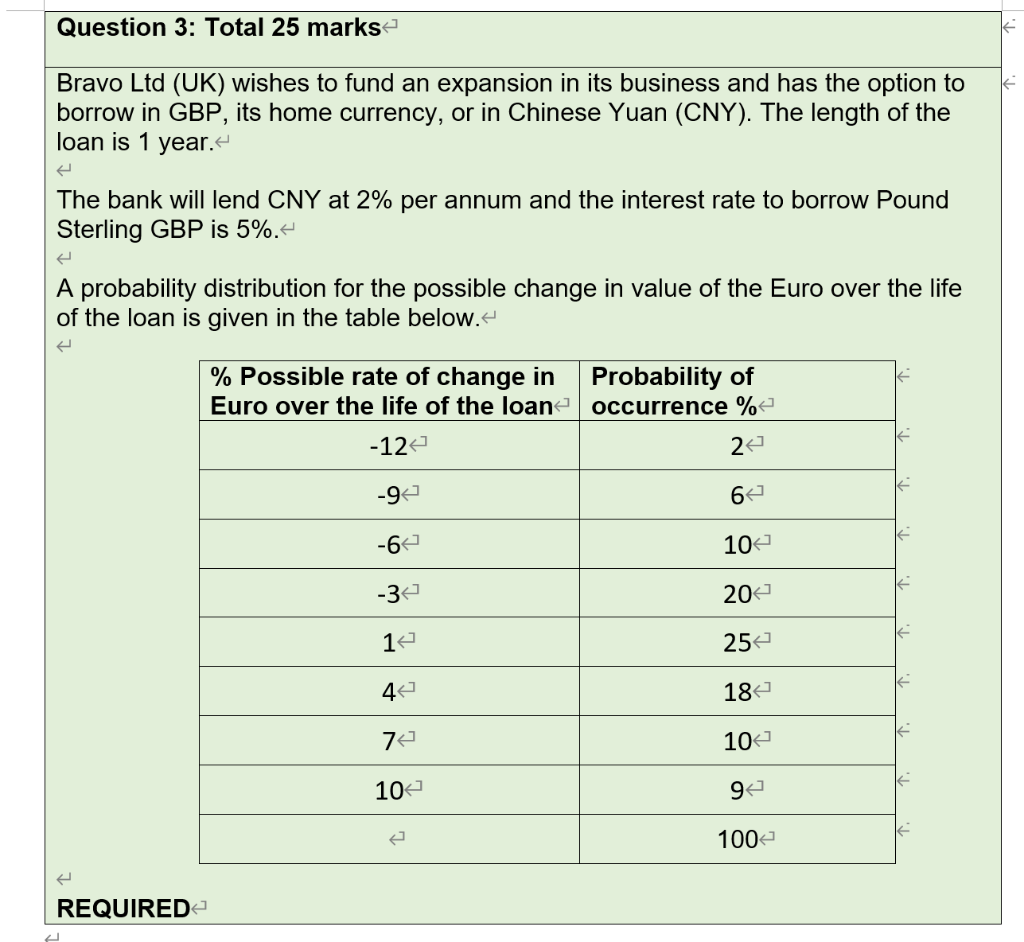

Question 3: Total 25 marks Bravo Ltd (UK) wishes to fund an expansion in its business and has the option to borrow in GBP, its home currency, or in Chinese Yuan (CNY). The length of the loan is 1 year. The bank will lend CNY at 2% per annum and the interest rate to borrow Pound Sterling GBP is 5%. A probability distribution for the possible change in value of the Euro over the life of the loan is given in the table below. % Possible rate of change in Probability of Euro over the life of the loan occurrence % -12 22 -94 64 -64 104 -34 20% >1 254 44 184 74 104 104 94 1002 REQUIRED a) Calculate the overall expected value of the effective CNY financing rate based on the calculations in (a) weighted by the probability of each outcome. [8 marks] Please provide the answer here; you may increase space where necessary b) Assess which currency should be used for financing providing support for your conclusion [2 marks]+ Please provide the answer here; you may increase space where necessary d) Briefly explain all three types of exposure of multinational corporations (MNCs) to exchange rate and interest rate risk - [7 marks] Please provide the answer here; you may increase space where necessary

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts