Question: No more information it is only the data shown bellow QUESTION 3: Assume a mean-variance opportunity set is constructed from two risky shares, A and

No more information it is only the data shown bellow

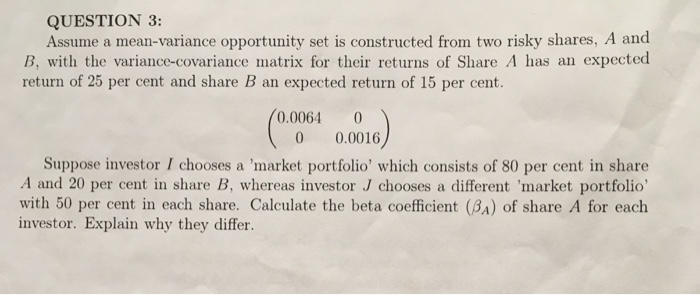

QUESTION 3: Assume a mean-variance opportunity set is constructed from two risky shares, A and B, with the variance-covariance matrix for their returns of Share A has an expected return of 25 per cent and share B an expected return of 15 per cent. (0.0064 0 ( 0 0.0016) Suppose investor / chooses a 'market portfolio' which consists of 80 per cent in share A and 20 per cent in share B, whereas investor J chooses a different 'market portfolio with 50 per cent in each share. Calculate the beta coefficient (BA) of share A for each investor. Explain why they differ. QUESTION 3: Assume a mean-variance opportunity set is constructed from two risky shares, A and B, with the variance-covariance matrix for their returns of Share A has an expected return of 25 per cent and share B an expected return of 15 per cent. (0.0064 0 ( 0 0.0016) Suppose investor / chooses a 'market portfolio' which consists of 80 per cent in share A and 20 per cent in share B, whereas investor J chooses a different 'market portfolio with 50 per cent in each share. Calculate the beta coefficient (BA) of share A for each investor. Explain why they differ

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts