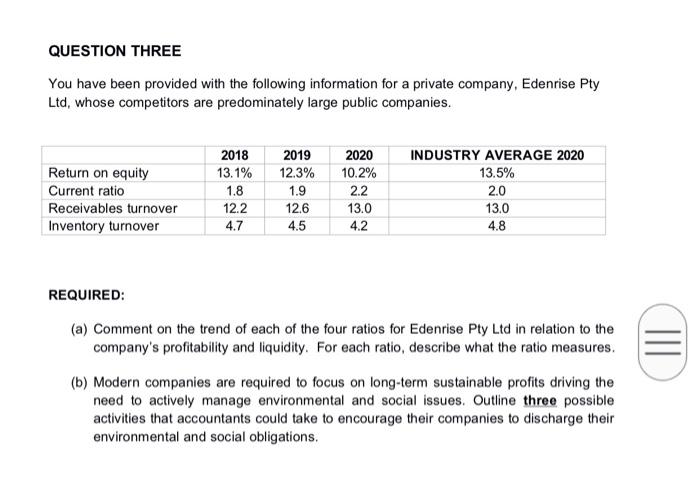

Question: No more. QUESTION THREE You have been provided with the following information for a private company, Edenrise Pty Ltd, whose competitors are predominately large public

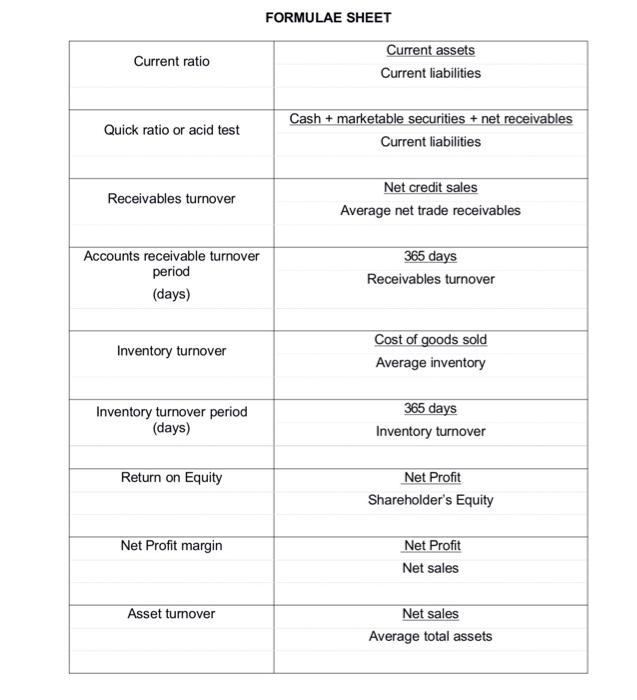

QUESTION THREE You have been provided with the following information for a private company, Edenrise Pty Ltd, whose competitors are predominately large public companies. 2019 12.3% 2018 13.1% 1.8 12.2 4.7 Return on equity Current ratio Receivables turnover Inventory turnover 1.9 2020 10.2% 2.2 13.0 4.2 INDUSTRY AVERAGE 2020 13.5% 2.0 13.0 4.8 12.6 4.5 REQUIRED: (a) Comment on the trend of each of the four ratios for Edenrise Pty Ltd in relation to the company's profitability and liquidity. For each ratio, describe what the ratio measures. III (b) Modern companies are required to focus on long-term sustainable profits driving the need to actively manage environmental and social issues. Outline three possible activities that accountants could take to encourage their companies to discharge their environmental and social obligations. FORMULAE SHEET Current assets Current ratio Current liabilities Cash + marketable securities + net receivables Quick ratio or acid test Current liabilities Receivables turnover Net credit sales Average net trade receivables 365 days Accounts receivable turnover period (days) Receivables turnover Inventory turnover Cost of goods sold Average inventory Inventory turnover period (days) 365 days Inventory turnover Return on Equity Net Profit Shareholder's Equity Net Profit margin Net Profit Net sales Asset turnover Net sales Average total assets

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts