Question: No need for a solution just write the correct option 3. A firm has a profit margin of 15% on sales of $20,000,000. If the

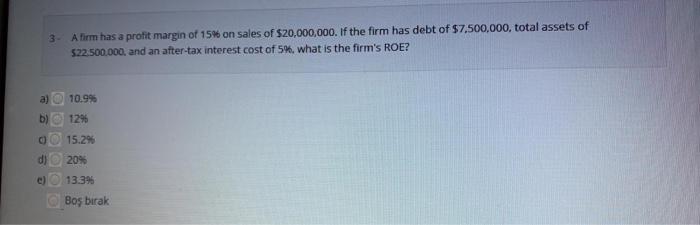

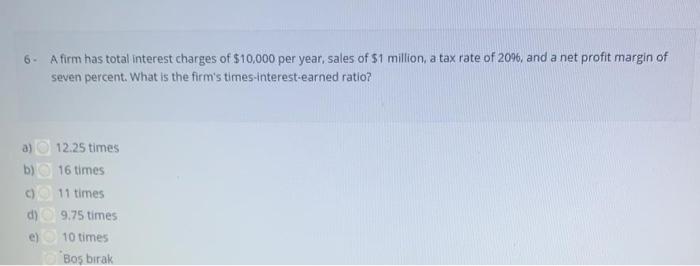

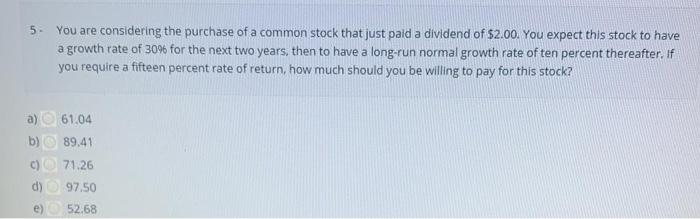

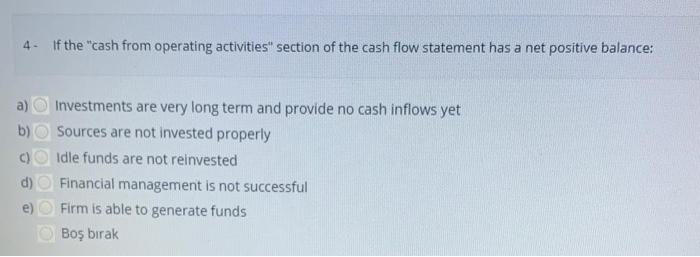

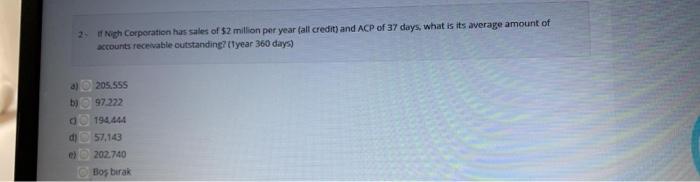

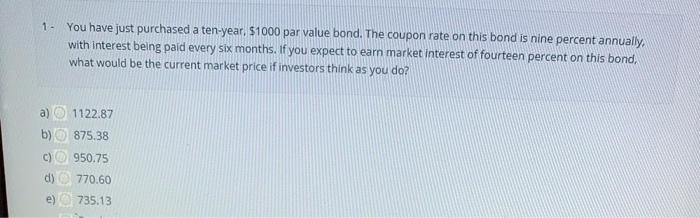

3. A firm has a profit margin of 15% on sales of $20,000,000. If the firm has debt of $7,500,000, total assets of 522.500.000, and an after-tax interest cost of 5%, what is the firm's ROE? a) 10.99 b) 12% 15.296 20% d) 13.396 Bos barak 6. Afirm has total interest charges of $10,000 per year, sales of $1 million, a tax rate of 209, and a net profit margin of seven percent. What is the firm's times-interest-earned ratio? a) 12.25 times 16 times b) d) 11 times 9.75 times 10 times Bo birak e) 5. You are considering the purchase of a common stock that just paid a dividend of $2.00. You expect this stock to have a growth rate of 3096 for the next two years, then to have a long-run normal growth rate of ten percent thereafter. If you require a fifteen percent rate of return how much should you be willing to pay for this stock? a 61.04 b) 89.41 71.26 97.50 d) e) 52.68 4. If the "cash from operating activities" section of the cash flow statement has a net positive balance: a b) Investments are very long term and provide no cash inflows yet Sources are not invested properly Idle funds are not reinvested Financial management is not successful Firm is able to generate funds Bo brak d) 2 Nigh Corporation has sales of $2 million per year (all credit) and ACP of 37 days, what is its average amount of accounts receivable outstanding?(year 360 days) 205 555 b) 97222 194.444 di 57,143 el 202.740 Bos brak 1 - You have just purchased a ten-year, $1000 par value bond. The coupon rate on this bond is nine percent annually with interest being paid every six months. If you expect to earn market interest of fourteen percent on this bond, what would be the current market price if investors think as you do? a) 1122.87 875.38 C) 950.75 d) 770.60 735.13

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts