Question: No need for explanation just the answer please During the end-of-period physical inventory count some of the inventory was counted twice. This caused ending inventory

No need for explanation just the answer please

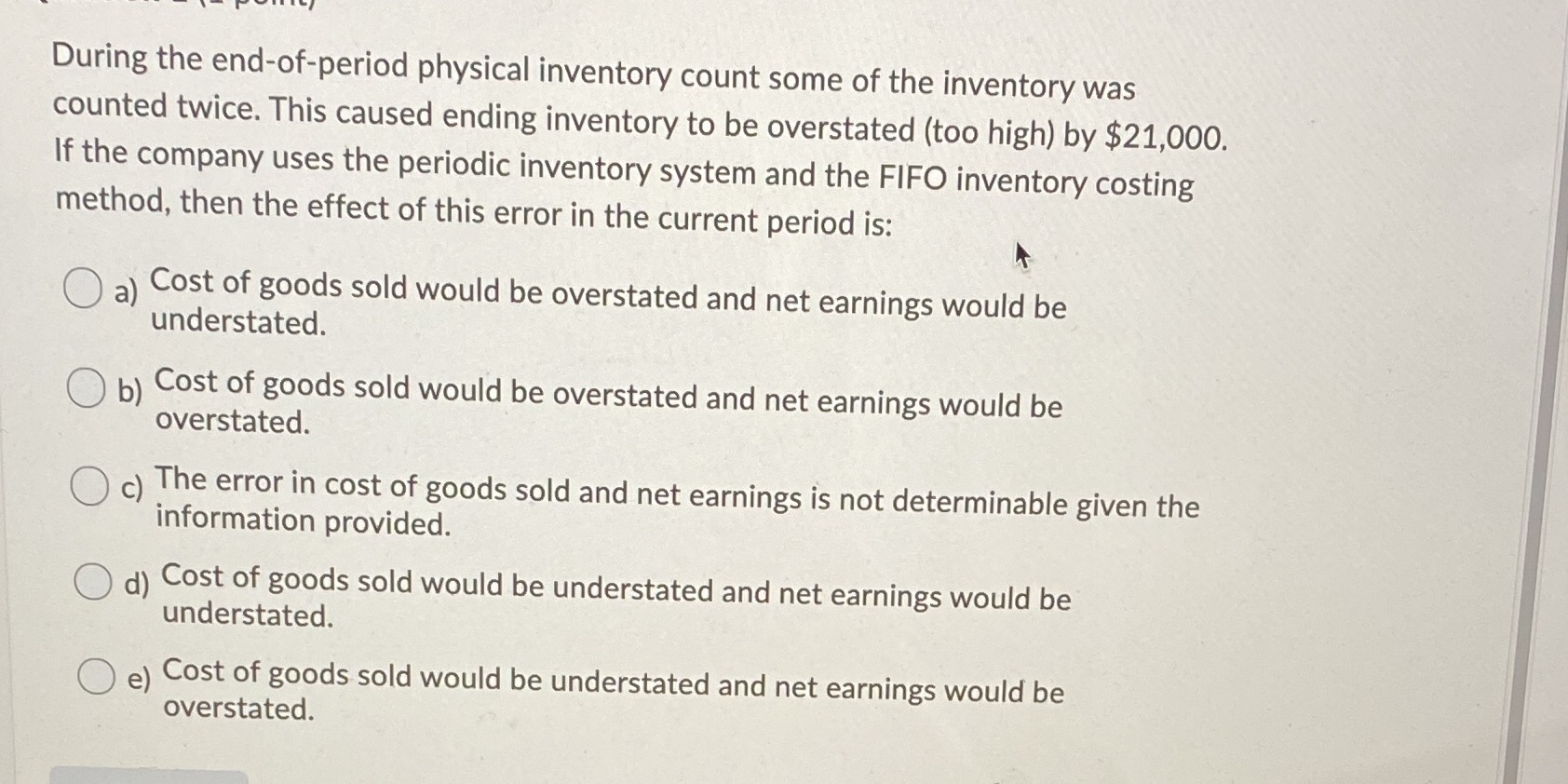

During the end-of-period physical inventory count some of the inventory was counted twice. This caused ending inventory to be overstated (too high) by $21,000. If the company uses the periodic inventory system and the FIFO inventory costing method, then the effect of this error in the current period is: O a) Cost of goods sold would be overstated and net earnings would be understated. (b) Cost of goods sold would be overstated and net earnings would be overstated. (c) The error in cost of goods sold and net earnings is not determinable given the information provided. O d) Cost of goods sold would be understated and net earnings would be understated. O e) Cost of goods sold would be understated and net earnings would be overstated

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts