Question: ** NO NEED FOR LECTURE NOTES PART 3. TIME-STATE PREFERENCE Lucy and Ricky live in a two-period, two-state exchange economy. They have the same utility

** NO NEED FOR LECTURE NOTES

** NO NEED FOR LECTURE NOTES

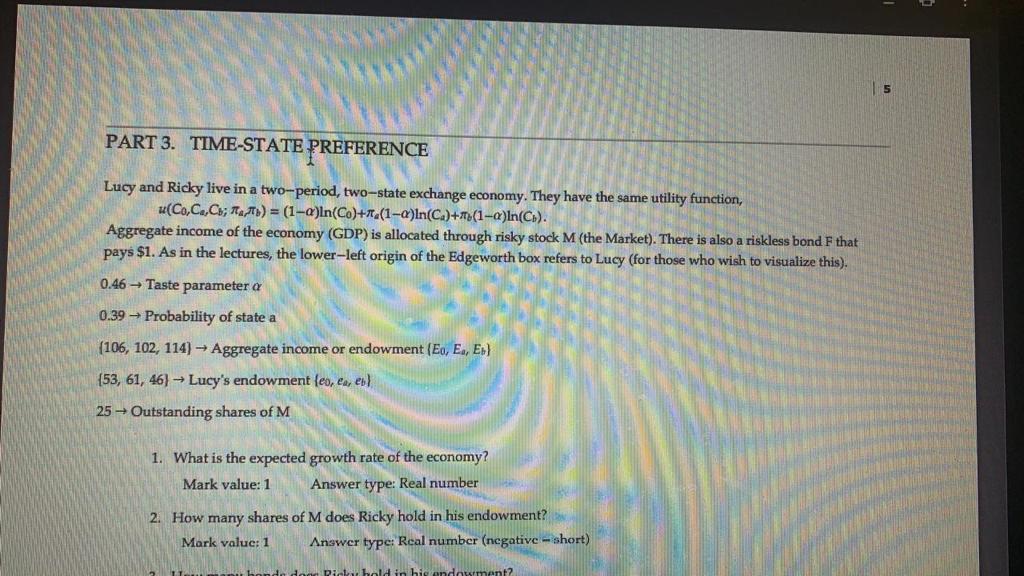

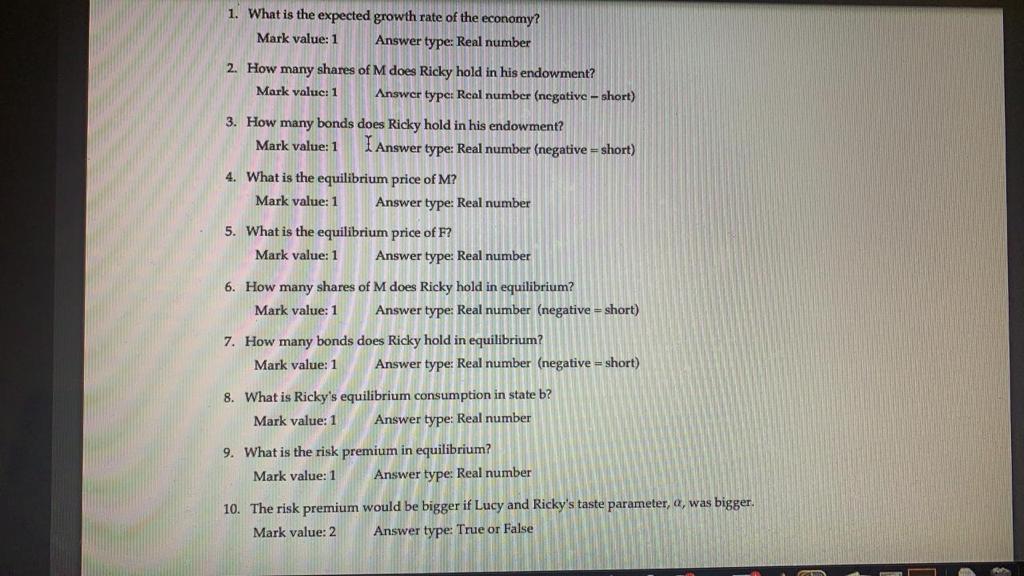

PART 3. TIME-STATE PREFERENCE Lucy and Ricky live in a two-period, two-state exchange economy. They have the same utility function, u(Co,Ce,Co; 1A) = (1-a)ln(Co)+(1-a)In(Ca)+7(1-0)In(Cs). Aggregate income of the economy (GDP) is allocated through risky stock M (the Market). There is also a riskless bond F that pays $1. As in the lectures, the lower-left origin of the Edgeworth box refers to Lucy (for those who wish to visualize this). 0.46 Taste parameter a 0.39 Probability of state a (106, 102, 114) Aggregate income or endowment (Eo, E., Es} (53, 61, 46) - Lucy's endowment (eo, ea, eb) 25 - Outstanding shares of M 1. What is the expected growth rate of the economy? Mark value: 1 Answer type: Real number 2. How many shares of M does Ricky hold in his endowment? Mark value: 1 Answer type: Real number (negative - short) pia baldin big ondowment 2 1. What is the expected growth rate of the economy? Mark value: 1 Answer type: Real number 2. How many shares of M does Ricky hold in his endowment? Mark value: 1 Answer type: Real number (negative - short) 3. How many bonds does Ricky hold in his endowment? Mark value: 1 I Answer type: Real number (negative = short) 4. What is the equilibrium price of M? Mark value: 1 Answer type: Real number 5. What is the equilibrium price of F? Mark value: 1 Answer type: Real number 6. How many shares of M does Ricky hold in equilibrium? Mark value: 1 Answer type: Real number (negative = short) 7. How many bonds does Ricky hold in equilibrium? Mark value: 1 Answer type: Real number (negative = short) 8. What is Ricky's equilibrium consumption in state b? Mark value: 1 Answer type: Real number 9. What is the risk premium in equilibrium? Mark value: 1 Answer type: Real number 10. The risk premium would be bigger if Lucy and Ricky's taste parameter, Q, was bigger. Mark value: 2 Answer type: True or False PART 3. TIME-STATE PREFERENCE Lucy and Ricky live in a two-period, two-state exchange economy. They have the same utility function, u(Co,Ce,Co; 1A) = (1-a)ln(Co)+(1-a)In(Ca)+7(1-0)In(Cs). Aggregate income of the economy (GDP) is allocated through risky stock M (the Market). There is also a riskless bond F that pays $1. As in the lectures, the lower-left origin of the Edgeworth box refers to Lucy (for those who wish to visualize this). 0.46 Taste parameter a 0.39 Probability of state a (106, 102, 114) Aggregate income or endowment (Eo, E., Es} (53, 61, 46) - Lucy's endowment (eo, ea, eb) 25 - Outstanding shares of M 1. What is the expected growth rate of the economy? Mark value: 1 Answer type: Real number 2. How many shares of M does Ricky hold in his endowment? Mark value: 1 Answer type: Real number (negative - short) pia baldin big ondowment 2 1. What is the expected growth rate of the economy? Mark value: 1 Answer type: Real number 2. How many shares of M does Ricky hold in his endowment? Mark value: 1 Answer type: Real number (negative - short) 3. How many bonds does Ricky hold in his endowment? Mark value: 1 I Answer type: Real number (negative = short) 4. What is the equilibrium price of M? Mark value: 1 Answer type: Real number 5. What is the equilibrium price of F? Mark value: 1 Answer type: Real number 6. How many shares of M does Ricky hold in equilibrium? Mark value: 1 Answer type: Real number (negative = short) 7. How many bonds does Ricky hold in equilibrium? Mark value: 1 Answer type: Real number (negative = short) 8. What is Ricky's equilibrium consumption in state b? Mark value: 1 Answer type: Real number 9. What is the risk premium in equilibrium? Mark value: 1 Answer type: Real number 10. The risk premium would be bigger if Lucy and Ricky's taste parameter, Q, was bigger. Mark value: 2 Answer type: True or False

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts