Question: No need for steps. only last answer. QI: What is the selling price today of a bond with a face value of S100,000,4% coupon paid

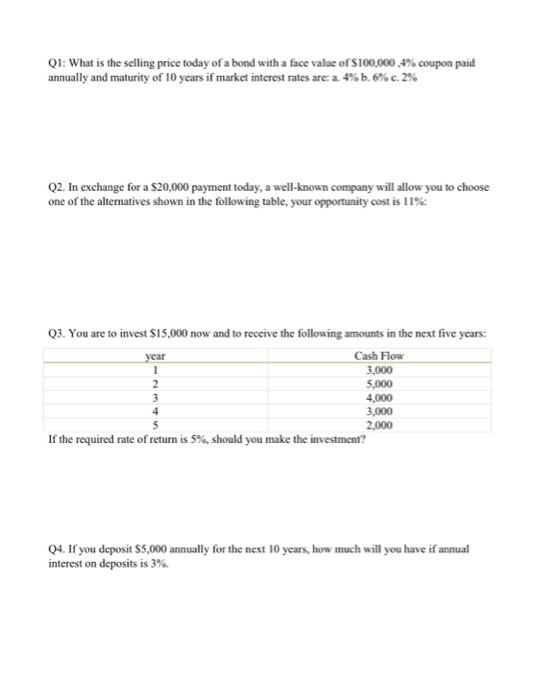

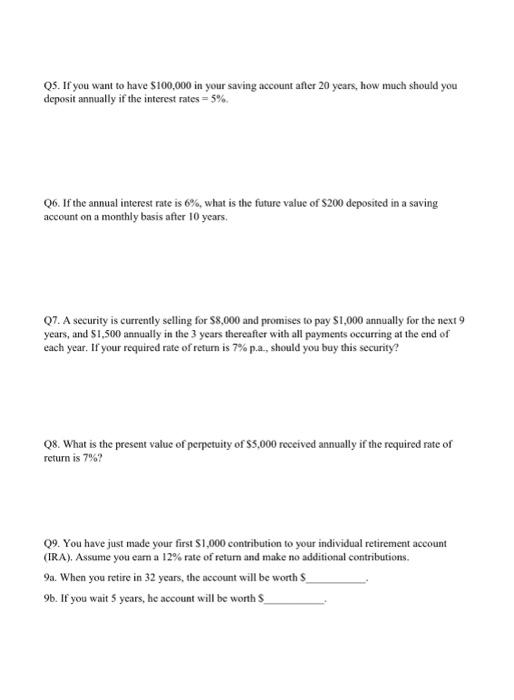

QI: What is the selling price today of a bond with a face value of S100,000,4% coupon paid annually and maturity of 10 years if market interest rates are: a. 4% 6,6% c.2% Q2. In exchange for a $20,000 payment today, a well-known company will allow you to choose one of the alternatives shown in the following table, your opportunity cost is 11% year 1 2 03. You are to invest $15,000 now and to receive the following amounts in the next five years: Cash Flow 3,000 5,000 3 4.000 3,000 2,000 If the required rate of return is 5%should you make the investment? 04. If you deposit 5,000 annually for the next 10 years, how much will you have if annual interest on deposits is 3% 05. If you want to have $100,000 in your saving account after 20 years, how much should you deposit annually if the interest rates = 5% 06. If the annual interest rate is 6%, what is the future value of $200 deposited in a saving account on a monthly basis after 10 years. 07. A security is currently selling for $8,000 and promises to pay $1,000 annually for the next 9 years, and $1,500 annually in the 3 years thereafter with all payments occurring at the end of each year. If your required rate of return is 7%p.a., should you buy this security? Q8. What is the present value of perpetuity of $3,000 received annually if the required rate of return is 7%? 09. You have just made your first $1,000 contribution to your individual retirement account (IRA). Assume you earn a 12% rate of return and make no additional contributions. 9a. When you retire in 32 years, the account will be worth 9b. If you wait 5 years, he account will be worth $ QI: What is the selling price today of a bond with a face value of S100,000,4% coupon paid annually and maturity of 10 years if market interest rates are: a. 4% 6,6% c.2% Q2. In exchange for a $20,000 payment today, a well-known company will allow you to choose one of the alternatives shown in the following table, your opportunity cost is 11% year 1 2 03. You are to invest $15,000 now and to receive the following amounts in the next five years: Cash Flow 3,000 5,000 3 4.000 3,000 2,000 If the required rate of return is 5%should you make the investment? 04. If you deposit 5,000 annually for the next 10 years, how much will you have if annual interest on deposits is 3% 05. If you want to have $100,000 in your saving account after 20 years, how much should you deposit annually if the interest rates = 5% 06. If the annual interest rate is 6%, what is the future value of $200 deposited in a saving account on a monthly basis after 10 years. 07. A security is currently selling for $8,000 and promises to pay $1,000 annually for the next 9 years, and $1,500 annually in the 3 years thereafter with all payments occurring at the end of each year. If your required rate of return is 7%p.a., should you buy this security? Q8. What is the present value of perpetuity of $3,000 received annually if the required rate of return is 7%? 09. You have just made your first $1,000 contribution to your individual retirement account (IRA). Assume you earn a 12% rate of return and make no additional contributions. 9a. When you retire in 32 years, the account will be worth 9b. If you wait 5 years, he account will be worth $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts