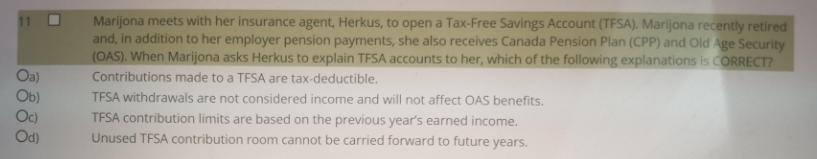

Question: Marijona meets with her insurance agent, Herkus, to open a Tax-Free Savings Account (TFSA). Marijona recently retired and, in addition to her employer pension

Marijona meets with her insurance agent, Herkus, to open a Tax-Free Savings Account (TFSA). Marijona recently retired and, in addition to her employer pension payments, she also receives Canada Pension Plan (CPP) and Old Age Security (OAS). When Marijona asks Herkus to explain TFSA accounts to her, which of the following explanations is CORRECT? Contributions made to a TFSA are tax-deductible. TFSA withdrawals are not considered income and will not affect OAS benefits. TFSA contribution limits are based on the previous year's earned income. Unused TFSA contribution room cannot be carried forward to future years. Oa) Ob) Oc) Od) 5888

Step by Step Solution

3.61 Rating (155 Votes )

There are 3 Steps involved in it

Option B is correct TFSA withdrawa... View full answer

Get step-by-step solutions from verified subject matter experts