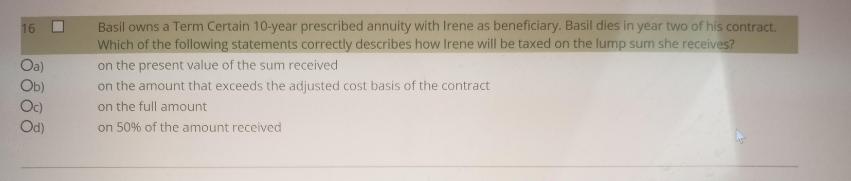

Question: Basil owns a Ternm Certain 10-year prescribed annuity with Irene as beneficiary. Basil dies in year two of his contract. Which of the following

Basil owns a Ternm Certain 10-year prescribed annuity with Irene as beneficiary. Basil dies in year two of his contract. Which of the following statements correctly describes how Irene will be taxed on the lump sum she receives? on the present value of the sum received on the amount that exceeds the adjusted cost basis of the contract 16 0 Oa) Ob) Oc) Od) on the full amount on 50% of the amount received

Step by Step Solution

3.32 Rating (152 Votes )

There are 3 Steps involved in it

Correct Answer C Explanation The beneficiary who is a inheriting the annuity basica... View full answer

Get step-by-step solutions from verified subject matter experts