Question: Jack and Marta are a married couple planning their retirement. Jack has a higher marginal tax rate (MTR) and is a member of his

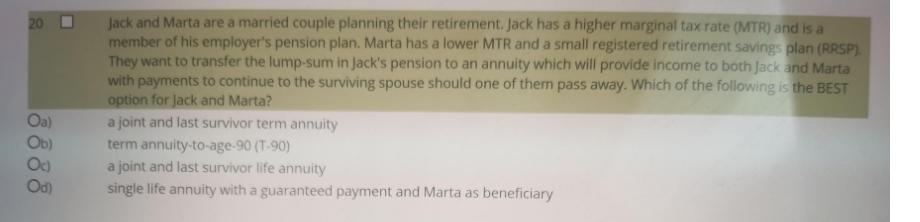

Jack and Marta are a married couple planning their retirement. Jack has a higher marginal tax rate (MTR) and is a member of his employer's pension plan. Marta has a lower MTR and a small registered retirement savings plan (RRSP). They want to transfer the lump-sum in Jack's pension to an annuity which will provide income to both Jack and Marta with payments to continue to the surviving spouse should one of them pass away. Which of the following is the BEST option for Jack and Marta? a joint and last survivor term annuity term annuity-to-age-90 (T-90) a joint and last survivor life annuity single life annuity with a guaranteed payment and Marta as beneficiary 20 0 Oa) Ob) Oc) Od)

Step by Step Solution

3.40 Rating (163 Votes )

There are 3 Steps involved in it

Answer C It provides income for l... View full answer

Get step-by-step solutions from verified subject matter experts