Question: No need to explain without explnation just i need option i will rate you Which of the following is the disadvantage of Net present value

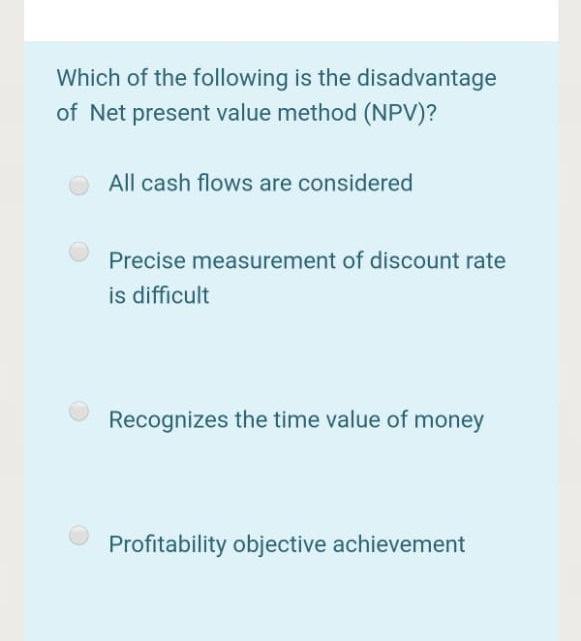

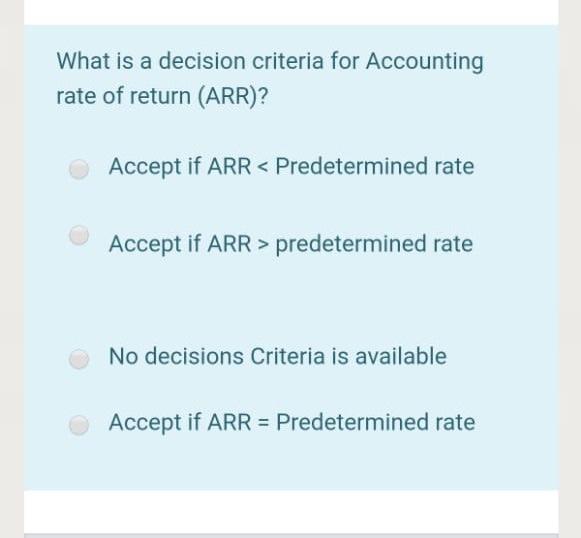

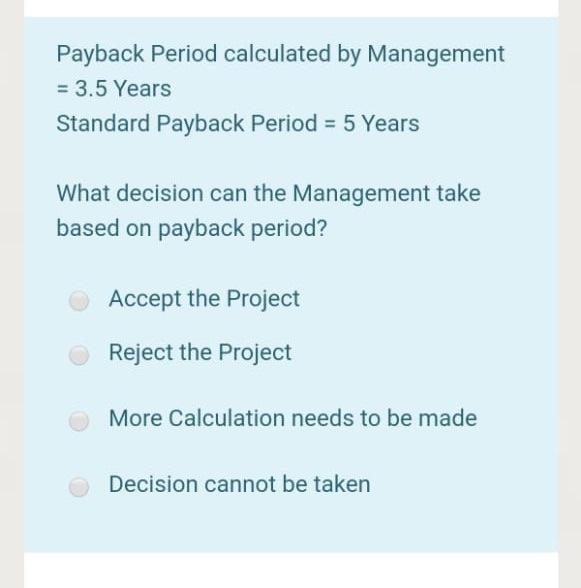

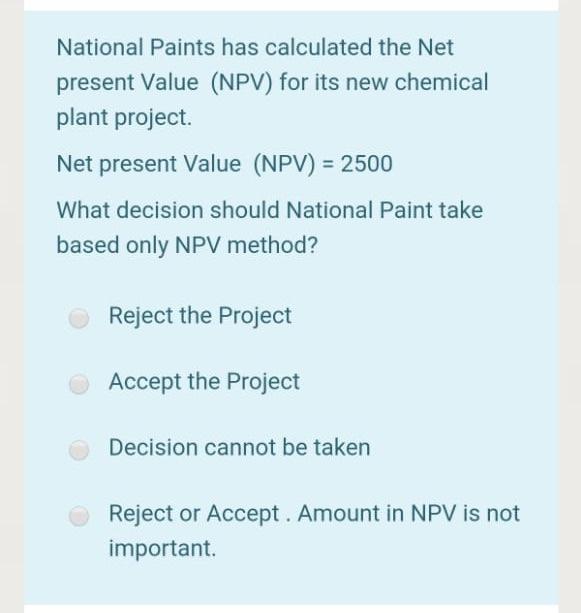

Which of the following is the disadvantage of Net present value method (NPV)? All cash flows are considered Precise measurement of discount rate is difficult Recognizes the time value of money Profitability objective achievement What is a decision criteria for Accounting rate of return (ARR)? Accept if ARR predetermined rate No decisions Criteria is available Accept if ARR = Predetermined rate Payback Period calculated by Management = 3.5 Years Standard Payback Period = 5 Years What decision can the Management take based on payback period? Accept the Project Reject the Project More Calculation needs to be made Decision cannot be taken National Paints has calculated the Net present Value (NPV) for its new chemical plant project Net present Value (NPV) = 2500 What decision should National Paint take based only NPV method? Reject the Project Accept the Project Decision cannot be taken Reject or Accept. Amount in NPV is not important

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts