Question: No need to use Excel! Please show work and explanation!! 2. Peter Penny received a Form 1099-B showing the following stock transactions and basis during

No need to use Excel! Please show work and explanation!!

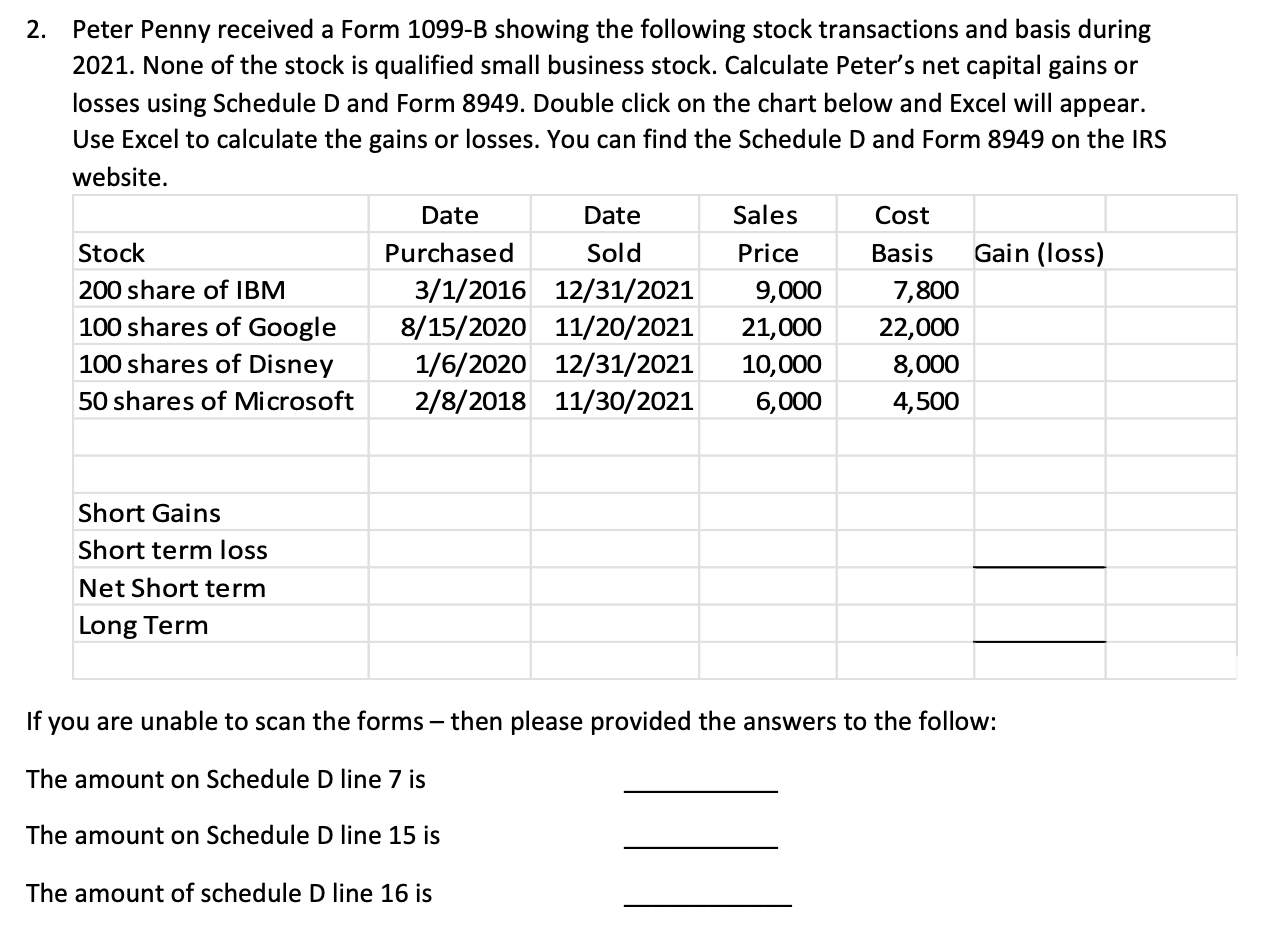

2. Peter Penny received a Form 1099-B showing the following stock transactions and basis during 2021. None of the stock is qualified small business stock. Calculate Peter's net capital gains or losses using Schedule D and Form 8949. Double click on the chart below and Excel will appear. Use Excel to calculate the gains or losses. You can find the Schedule D and Form 8949 on the IRS website. If you are unable to scan the forms - then please provided the answers to the follow: The amount on Schedule D line 7 is The amount on Schedule D line 15 is The amount of schedule D line 16 is

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts