Question: no work needed. just answer question! thanks! 15 4 points PI is a private firm that used to finance its projects with a debt-to-equity ratio

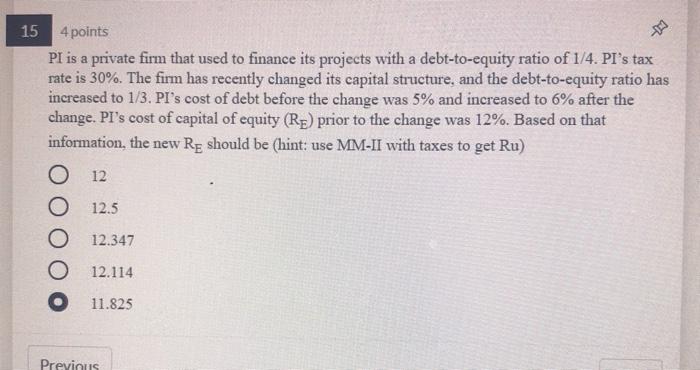

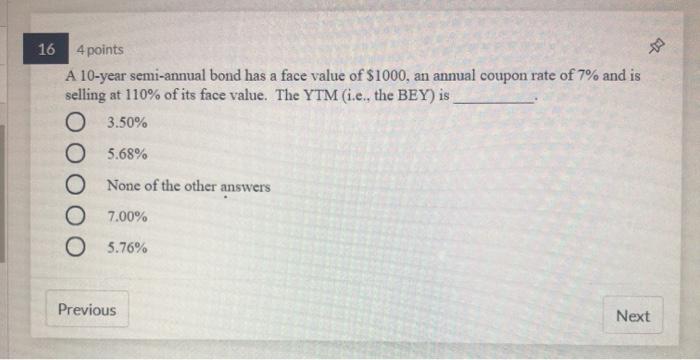

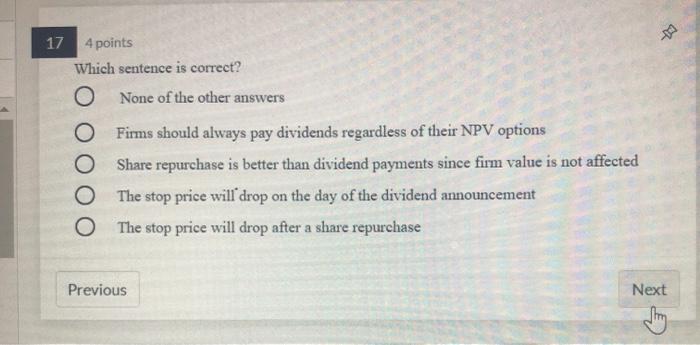

15 4 points PI is a private firm that used to finance its projects with a debt-to-equity ratio of 1/4. PI's tax rate is 30%. The firm has recently changed its capital structure, and the debt-to-equity ratio has increased to 1/3. PI's cost of debt before the change was 5% and increased to 6% after the change. PI's cost of capital of equity (Rp) prior to the change was 12%. Based on that information, the new Rg should be (hint: use MM-II with taxes to get Ru) O 12 O 12.5 12.347 O 12.114 O 11.825 Previous 16 4 points A 10-year semi-annual bond has a face value of $1000, an annual coupon rate of 7% and is selling at 110% of its face value. The YTM (i.c., the BEY) is O 3.50% O 5.68% None of the other answers O 7.00% O 5.76% Previous Next 17 4 points Which sentence is correct? None of the other answers O Firms should always pay dividends regardless of their NPV options Share repurchase is better than dividend payments since firm value is not affected The stop price will drop on the day of the dividend announcement The stop price will drop after a share repurchase Previous Next

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts