Question: no work needed. just answers please! 3 w 4 points Giraffe Inc. common stock has a beta of 1.37, the risk-free rate is 3.4 percent,

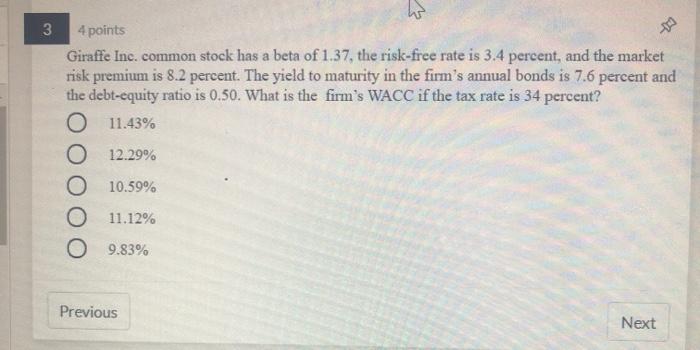

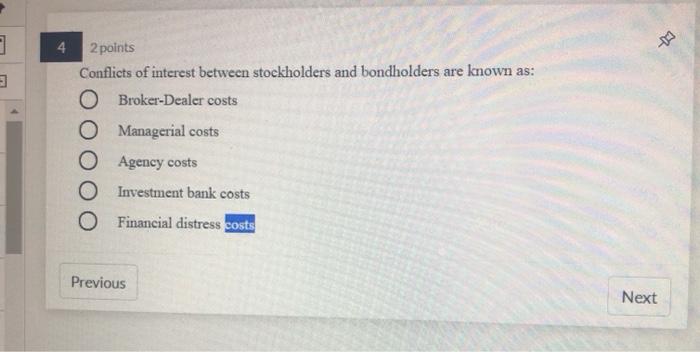

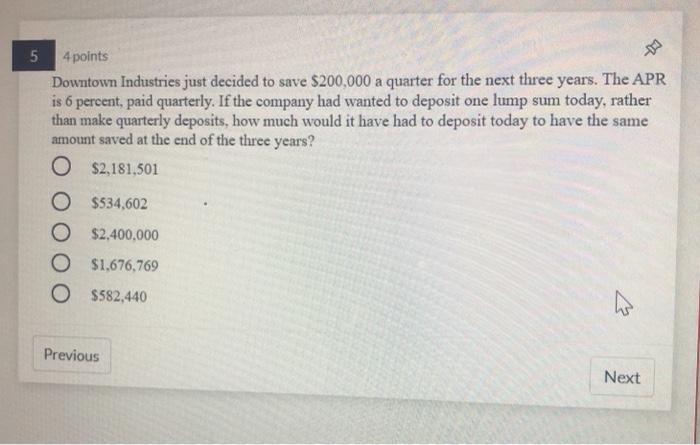

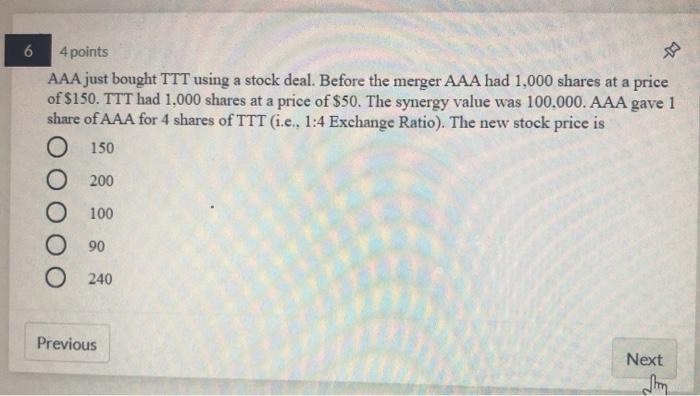

3 w 4 points Giraffe Inc. common stock has a beta of 1.37, the risk-free rate is 3.4 percent, and the market risk premium is 8.2 percent. The yield to maturity in the firm's annual bonds is 7.6 percent and the debt-equity ratio is 0.50. What is the firm's WACC if the tax rate is 34 percent? O 11.43% O 12.29% 0 10.59% O 11.12% o 9.83% Previous Next 4 -D3 ] 3 2 points Conflicts of interest between stockholders and bondholders are known as: O Broker-Dealer costs O Managerial costs Agency costs Investment bank costs Financial distress costs Previous Next 5 4 points Downtown Industries just decided to save $200,000 a quarter for the next three years. The APR is 6 percent, paid quarterly. If the company had wanted to deposit one lump sum today, rather than make quarterly deposits, how much would it have had to deposit today to have the same amount saved at the end of the three years? O $2,181,501 O $534,602 O $2,400,000 $1.676,769 O $582,440 Previous Next 6 4 points AAA just bought TTT using a stock deal. Before the merger AAA had 1,000 shares at a price of $150. TTT had 1,000 shares at a price of $50. The synergy value was 100,000. AAA gave 1 share of AAA for 4 shares of TTT (i.e., 1:4 Exchange Ratio). The new stock price is 0 150 O 200 100 90 240 Previous Next

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts