Question: nobody is willing to answer this :( please help my third try Part B: Provide all calculations and related journal entries for the following case:

nobody is willing to answer this :( please help my third try

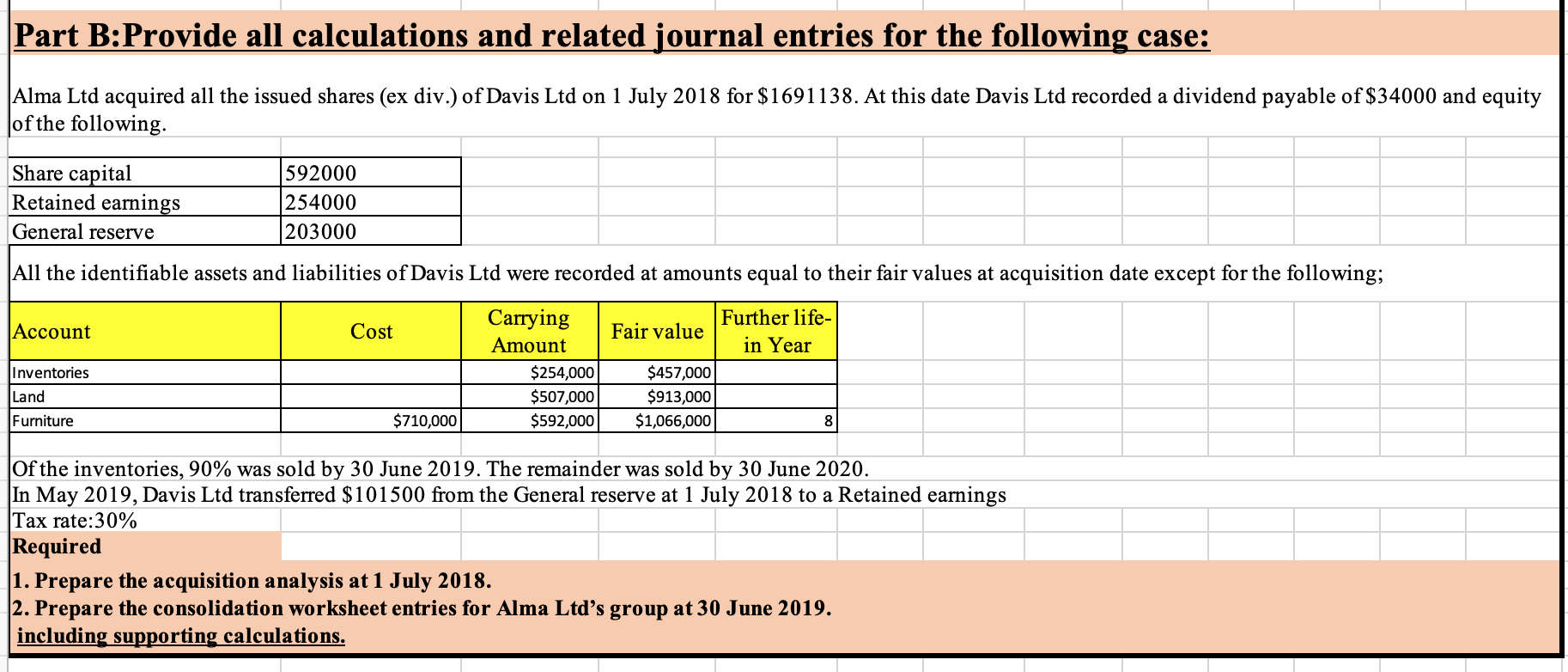

Part B: Provide all calculations and related journal entries for the following case: Alma Lid acquired all the issued shares (ex div.) of Davis Lid on 1 July 2018 for $1691 138. At this date Davis Ltd recorded a dividend payable of $34000 and equity of the following. Share capital 592000 Retained earnings 254000 General reserve 203000 All the identifiable assets and liabilities of Davis Ltd were recorded at amounts equal to their fair values at acquisition date except for the following; Account Cost Carrying Fair value Further life- Amount in Year Inventories $254,00 $457,000 Land $507,000 $913,000 Furniture $710,000 $592,000 $1,066,000 Of the inventories, 90% was sold by 30 June 2019. The remainder was sold by 30 June 2020. In May 2019, Davis Ltd transferred $101500 from the General reserve at 1 July 2018 to a Retained earnings Tax rate:30% Required 1. Prepare the acquisition analysis at 1 July 2018. 2. Prepare the consolidation worksheet entries for Alma Ltd's group at 30 June 2019. including supporting calculations

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts