Question: Non - Arm's Length Transfers 2 4 . What if Jenny of Question 1 9 gave the van to her sister? Or sold it to

NonArm's Length Transfers

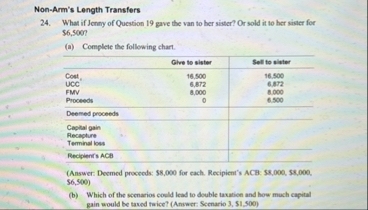

What if Jenny of Question gave the van to her sister? Or sold it to her sister for $

a Complete the following chart.

tableGive to sister,Sell to sibterCostUCCFMVProcesedsDeemed proceeds,Capital gain,,Recaptire Terminal loss,,Reciplenfs ACB,,

Answer: Deemed proceeds: $ for each. Recipient's ACB: $$ $

b Which of the scenarios conld lead to double taxation and how much capital gain would be tased trice? Answer: Scenario $

A ONLY PLEASE

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock