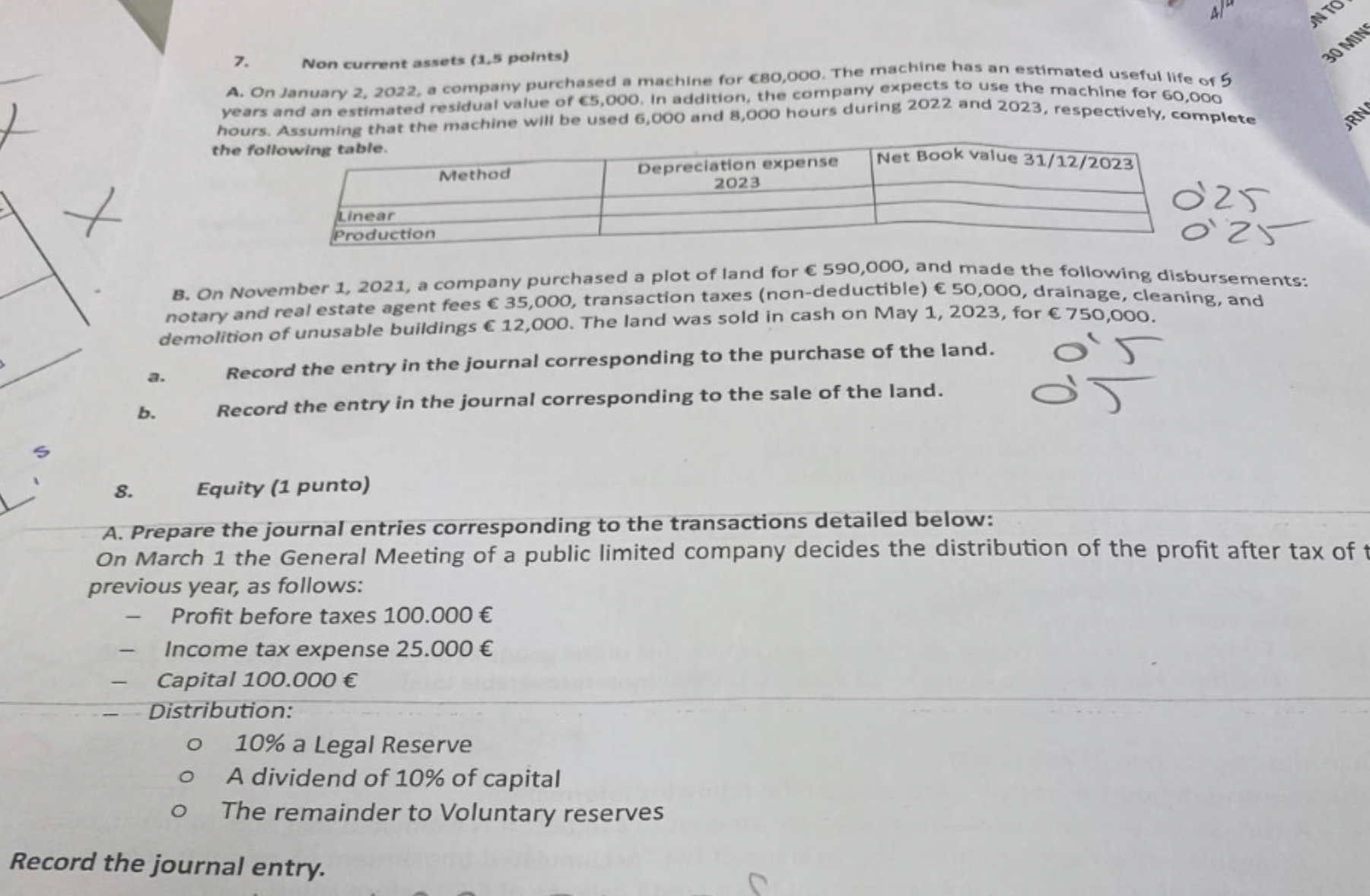

Question: Non current assets ( 1 , 5 points ) A . On January 2 , 2 0 2 2 , a company purchased a machine

Non current assets points

A On January a company purchased a machine for The machine has an estimated useful life of

years and an estimated residual value of In addition, the company expects to use the machine for

hours. Assuming that the machine will be used and hours during and respectively, complete

the following table.

B On November a company purchased a plot of land for and made the following disbursements:

notary and real estate agent fees transaction taxes nondeductible drainage, cleaning, and

demolition of unusable buildings The land was sold in cash on May for

a Record the entry in the journal corresponding to the purchase of the land.

b Record the entry in the journal corresponding to the sale of the land.

Equity punto

A Prepare the journal entries corresponding to the transactions detailed below:

On March the General Meeting of a public limited company decides the distribution of the profit after tax of

previous year, as follows:

Profit before taxes

Income tax expense

Capital

Distribution:

a Legal Reserve

A dividend of of capital

The remainder to Voluntary reserves

Record the journal entry.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock