Question: Non - linear blending model: There has been a lot of soul searching recently at your company, the Beansoul Coal Company ( BCC ) .

Nonlinear blending model:

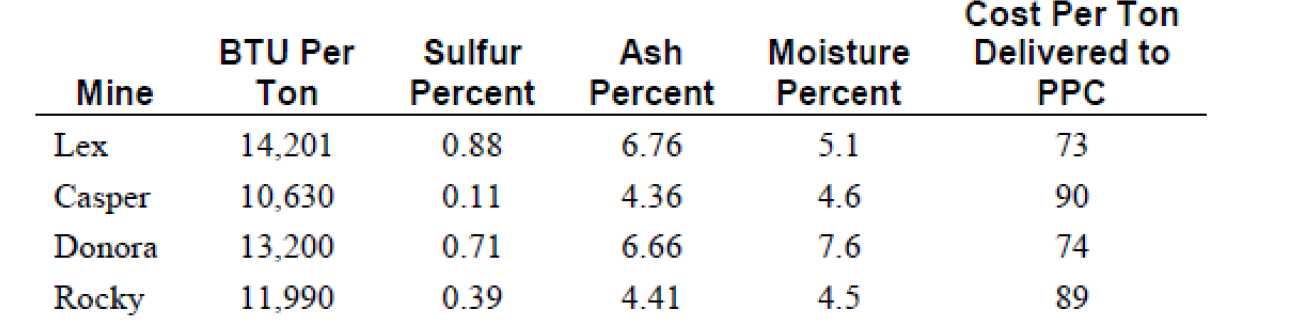

There has been a lot of soul searching recently at your company, the Beansoul Coal Company BCC Some of its better coal mines have been exhausted and it is having more difficulty selling its coal from remaining mines. One of BCCs most important customers is the electrical utility, Power to the People Company PPC BCC sells coal from its best mine, the Becky mine, to PPC The Becky mine is currently running at capacity, selling all its tonsday of output to PPC Delivered to PPC the Becky coal costs BCC $ton and PPC pays BCC $ton BCC has four other mines, but you have been unable to get PPC to buy coal from these mines. PPC says that coal from these mines does not satisfy its quality requirements. Upon pressing PPC for details, it has agreed it would consider buying a mix of coal as long as it satisfies the following quality requirements: sulfur ; ash ; BTU per ton; and moisture You note your Becky mine satisfies this in that its quality according to the above four measures is: BTU, and Your four other mines have the following characteristics:

The daily capacities of your Lex, Casper, Donora, and Rocky mines are and tons respectively. PPC uses an average of about tons per day.

BCCs director of sales was ecstatic upon hearing of your conversation with PPC His response was Great Now, we will be able sell PPC all of the tons per day it needs Your stock with BCCs newly appointed director of productivity is similarly high. Her reaction to your discussion with PCC was: Lets see, right now we are making a profit contribution of only $ton of coal sold to PPC I have figured out we can make a profit contribution of $ton if we can sell them a mix. Wow! You are an ingenious negotiator! What do you recommend to BCC

NOTE: The demo version of LINGO does not provide enough nonlinear variables to solve this optimization, so you will need to develop a linearized model with cleared denominators.

HINT: also, dont forget to include the Becky mine in your solution

Objectives

The goal of this case study is to formulate an optimization model using LINGO to analyze

Beansoul Coal Companys BCC production options. Begin by following the structured

modeling process:

Frame the problem

What decisions does BCC need to make?

What are the decision variables?

What are the limitsconstraints affecting the decision?

How should BCC determine if the solution is optimal?

What alternatives need to be considered?

Construct a LINGO model to analyze the decision using SETS and DATA. All the data

you need is contained in either the problem statement or the table of mines,

Pay attention to the units of measurement tons percentages, etc. to make sure you

analyze the case properly. This is particularly important when you use linearized

constraints with cleared denominators.

Your analysis of this case should include the answers to the following questions:

What is the optimal blend of coal that meets PPCs requirements?

What are the specifications sulfur ash, moisture and BTU of the blended coal?

Which blend qualities are binding constraints?

Which, if any, mine capacities are binding constraints?

What is the average cost $ton to produce the coal blend?

How does your expected profit compare to the $ton the director of sales estimated?

If PPC only pays Beansoul Coal $ton how can Beansoul justify selling coal from

mines that cost more than $ton to produce?

Mine

BTU Per Ton

Sulfur Percent

Ash Percent

Moisture Percent

Cost Per Ton Delivered to PPC

Lex Casper Donora Rocky begintabularlccccc

multicolumnc Mine & begintabularc

BTU Per

Ton

endtabular & begintabularc

Sulfur

Percent

endtabular & begintabularc

Ash

Percent

endtabular & begintabularc

Moisture

Percent

endtabular & begintabularc

Cost Per Ton

Delivered to

PPC

endtabular

hline Lex & & & & &

Casper & & & & &

Donora & & & & &

Rocky & & & & &

endtabular

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock