Question: Nonlinear Optimisation 2020/21- Assignment For questions 1, 3 & 5 you must hand in print-outs of MATLAB M-files for the function used and computer results.

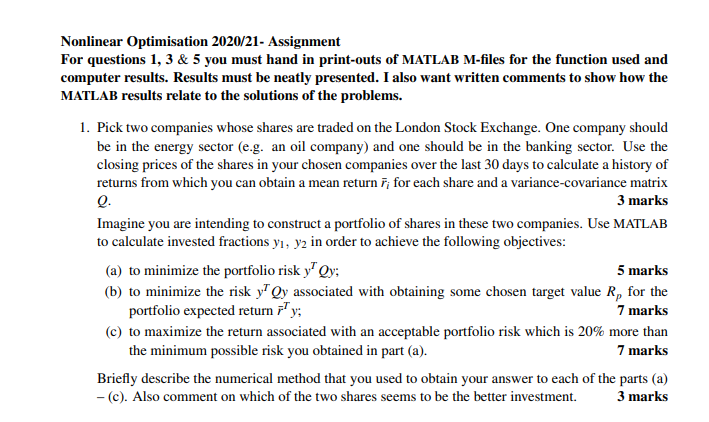

Nonlinear Optimisation 2020/21- Assignment For questions 1, 3 & 5 you must hand in print-outs of MATLAB M-files for the function used and computer results. Results must be neatly presented. I also want written comments to show how the MATLAB results relate to the solutions of the problems. 1. Pick two companies whose shares are traded on the London Stock Exchange. One company should be in the energy sector (e.g. an oil company) and one should be in the banking sector. Use the closing prices of the shares in your chosen companies over the last 30 days to calculate a history of returns from which you can obtain a mean return F; for each share and a variance-covariance matrix Q. 3 marks Imagine you are intending to construct a portfolio of shares in these two companies. Use MATLAB to calculate invested fractions yi, y2 in order to achieve the following objectives: (a) to minimize the portfolio risk y' Qy; 5 marks (b) to minimize the risk yQy associated with obtaining some chosen target value R, for the portfolio expected return "y; 7 marks (c) to maximize the return associated with an acceptable portfolio risk which is 20% more than the minimum possible risk you obtained in part (a). 7 marks Briefly describe the numerical method that you used to obtain your answer to each of the parts (a) -(C). Also comment on which of the two shares seems to be the better investment. 3 marks Nonlinear Optimisation 2020/21- Assignment For questions 1, 3 & 5 you must hand in print-outs of MATLAB M-files for the function used and computer results. Results must be neatly presented. I also want written comments to show how the MATLAB results relate to the solutions of the problems. 1. Pick two companies whose shares are traded on the London Stock Exchange. One company should be in the energy sector (e.g. an oil company) and one should be in the banking sector. Use the closing prices of the shares in your chosen companies over the last 30 days to calculate a history of returns from which you can obtain a mean return F; for each share and a variance-covariance matrix Q. 3 marks Imagine you are intending to construct a portfolio of shares in these two companies. Use MATLAB to calculate invested fractions yi, y2 in order to achieve the following objectives: (a) to minimize the portfolio risk y' Qy; 5 marks (b) to minimize the risk yQy associated with obtaining some chosen target value R, for the portfolio expected return "y; 7 marks (c) to maximize the return associated with an acceptable portfolio risk which is 20% more than the minimum possible risk you obtained in part (a). 7 marks Briefly describe the numerical method that you used to obtain your answer to each of the parts (a) -(C). Also comment on which of the two shares seems to be the better investment. 3 marks

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts