Question: Normal Heading 1 Heading 2 Heading 3 Heading 4 New Question 4 April, a calendar year taxpayer, is a 30% partner in Pawnee Partnership. For

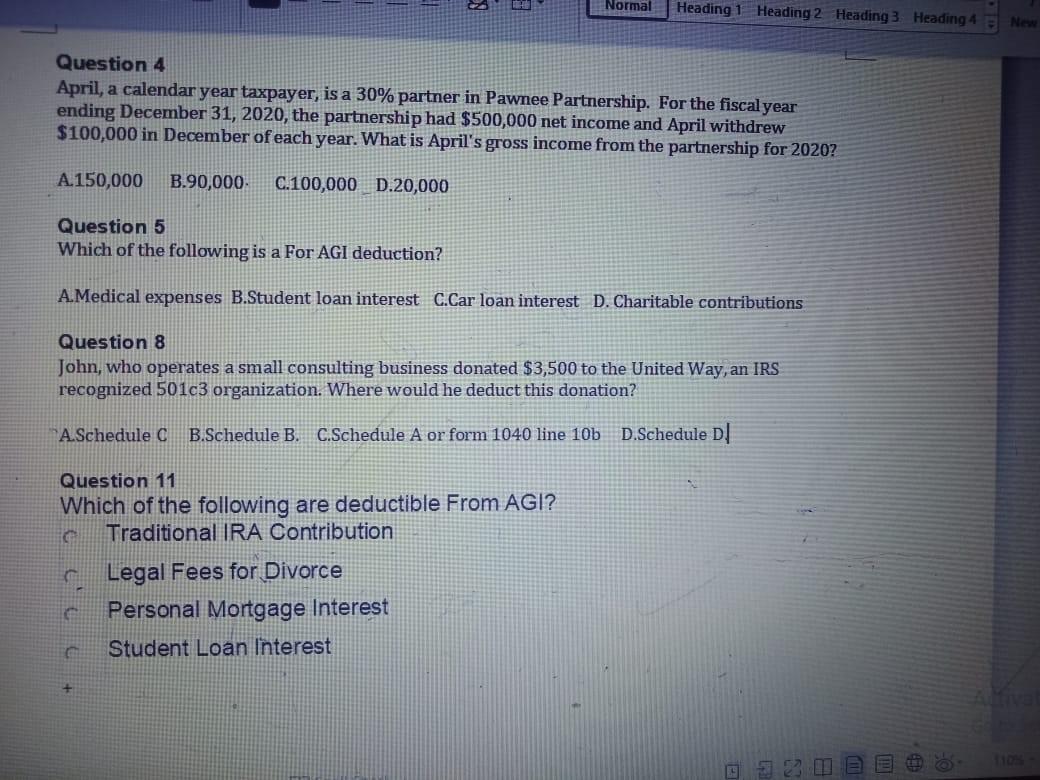

Normal Heading 1 Heading 2 Heading 3 Heading 4 New Question 4 April, a calendar year taxpayer, is a 30% partner in Pawnee Partnership. For the fiscal year ending December 31, 2020, the partnership had $500,000 net income and April withdrew $100,000 in December of each year. What is April's gross income from the partnership for 2020? A.150,000 B.90,000 C.100,000 D.20,000 Question 5 Which of the following is a For AGI deduction? A.Medical expenses B.Student loan interest C.Car loan interest D. Charitable contributions Question 8 John, who operates a small consulting business donated $3,500 to the United Way, an IRS recognized 501c3 organization. Where would he deduct this donation? A.Schedule C B.Schedule B. C.Schedule A or form 1040 line 10b D.Schedule D Question 11 Which of the following are deductible From AGI? Traditional IRA Contribution Legal Fees for Divorce Personal Mortgage Interest Student Loan Interest + E DE 3

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts