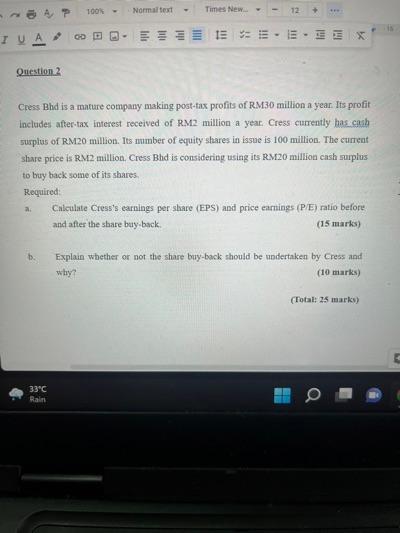

Question: Normal text Times New... 12 *** - X Question 2 Cress Bhd is a mature company making post-tax profits of RM30 million a year. Its

Normal text Times New... 12 *** - X Question 2 Cress Bhd is a mature company making post-tax profits of RM30 million a year. Its profit includes after-tax interest received of RM2 million a year. Cress currently has cash surplus of RM20 million. Its number of equity shares in issue is 100 million. The current share price is RM2 million. Cress Bhd is considering using its RM20 million cash surplus to buy back some of its shares. Required: a. Calculate Cress's earnings per share (EPS) and price earnings (P/E) ratio before and after the share buy-back. (15 marks) Explain whether or not the share buy-back should be undertaken by Cress and why? (10 marks) (Total: 25 marks) 33C Rain 100% 00- + 4. File Edit View Insert Format Tools Extensions 47 100%- Normal text Times New... 12 + FAST 2 1956 789 11 (2 13 Question 1 Ali Berhad is a KL-based manufacturing company. The company has a weighted average cost of capital of 10%, and is financed partly by equity (cost 12%) and partly by debt capital (cost 8%). The company is considering acquiring Granvi Berhad, a design company. The acquisition of Granvi Berhad would cost RM10m, however the acquisition is expected to yield additional annual profits of RM2m before interest charges. The company expects to finance the investment with a further loan at a cost of 8% per annum As a result of this additional borrowing, the company expects its cost of equity to rise to 15%. The company pays out all profits as dividends, which are currently RM3.6m a year. You may assume the traditional view of WACC and gearing. Required: a Calculate the effect of acquiring Granvi Berhad on the value of Ali Berhad's equity. (10 marks) b. Calculate the extent to which the change in the value of Ali Berhad's equity is caused by: (10 marks) The NPV of the project at the current WACC ii. The method of financing C. Briefly explain why the company's cost of equity would increase as the company increases its total borrowing. (5 marks) (Total: 25 marks) 33C Rain

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts