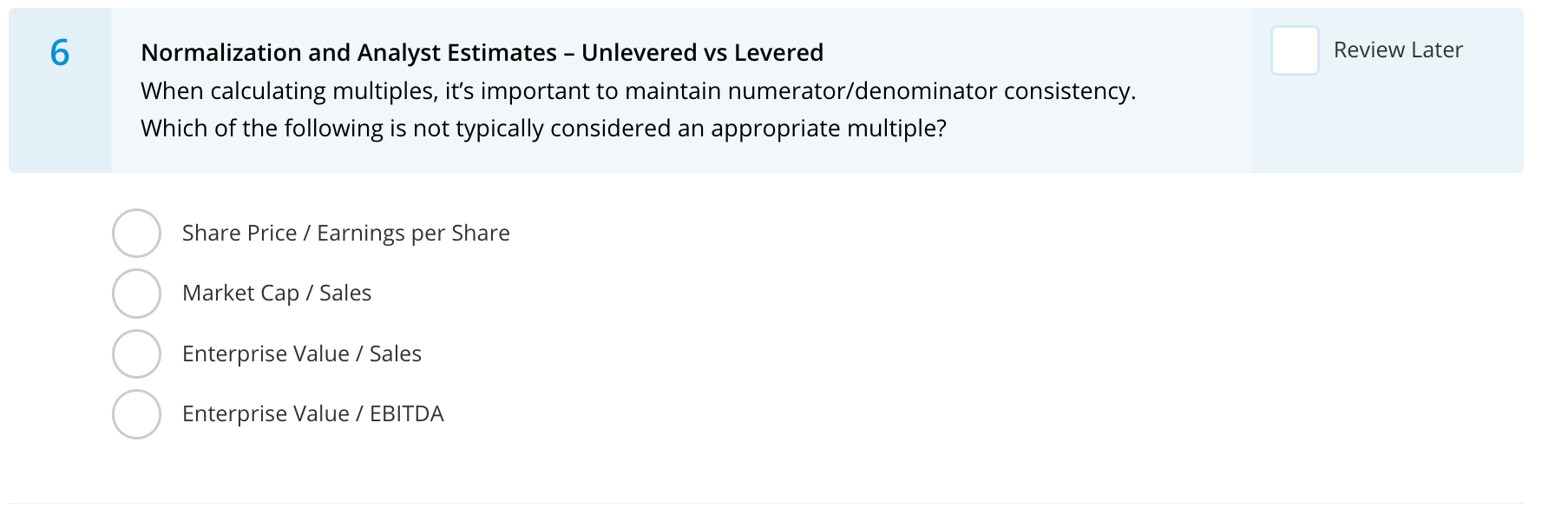

Question: Normalization and Analyst Estimates - Unlevered vs Levered When calculating multiples, it's important to maintain numerator/denominator consistency. Which of the following is not typically considered

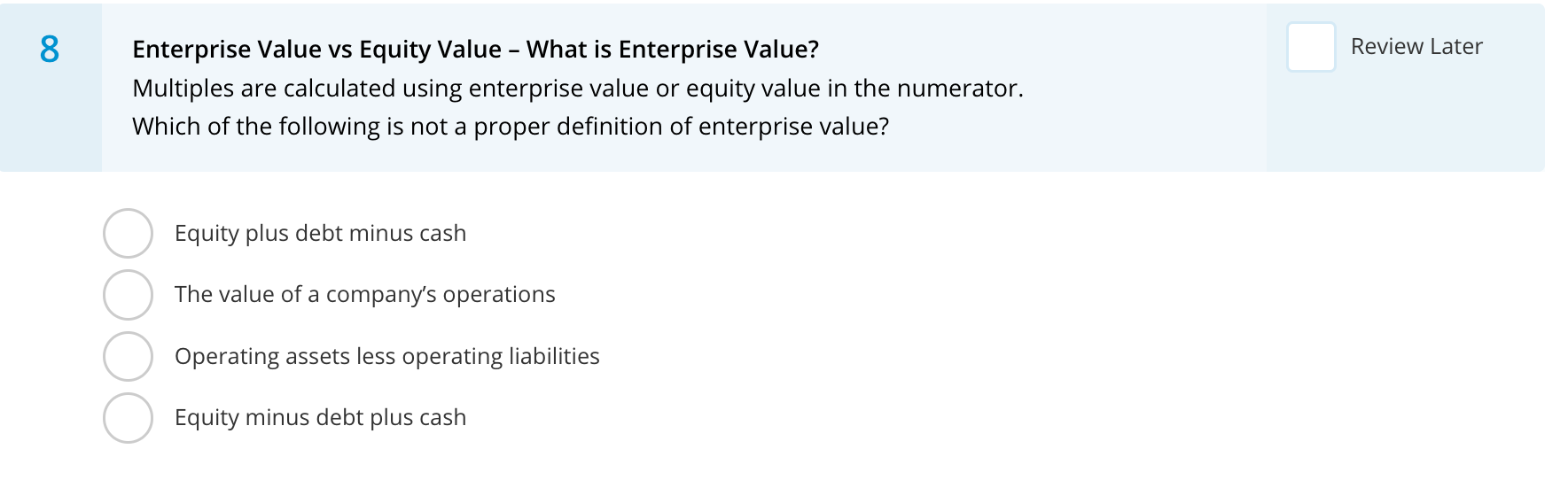

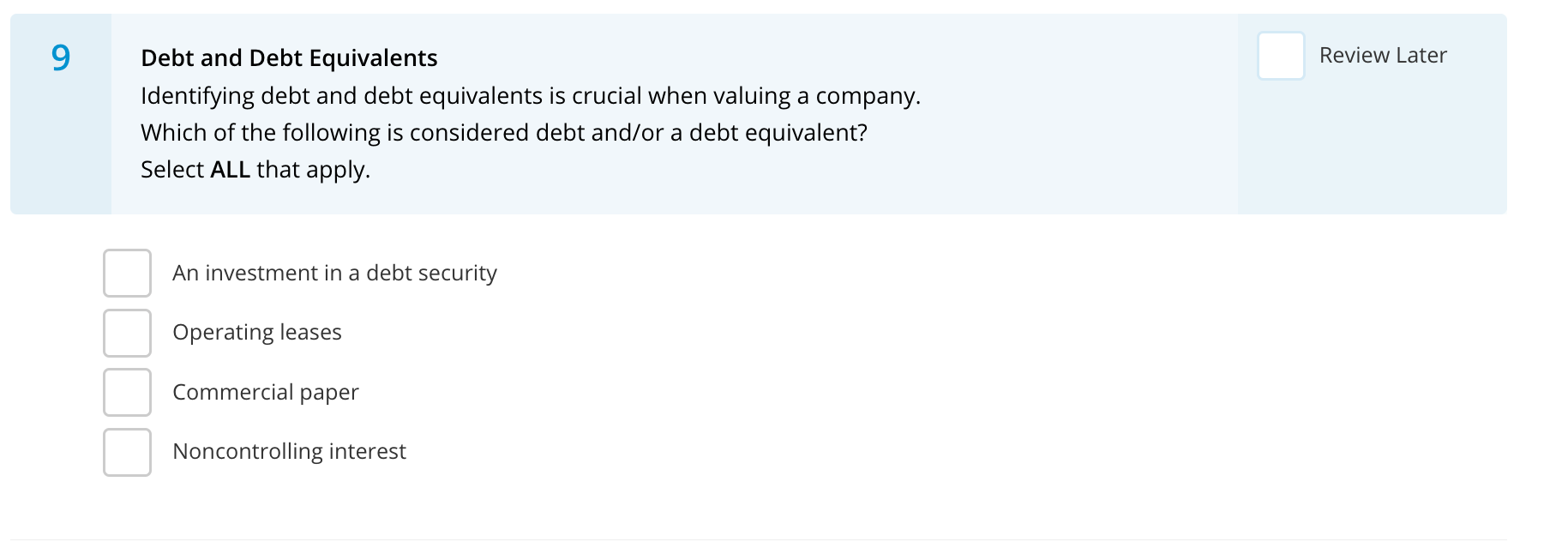

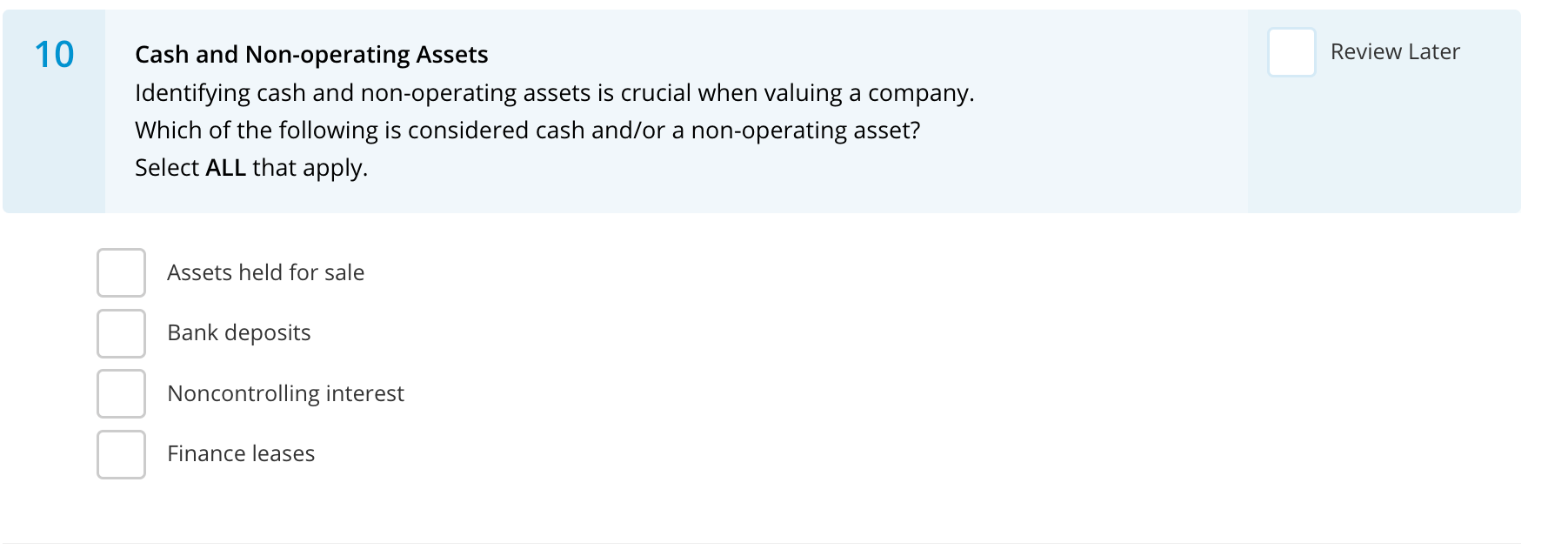

Normalization and Analyst Estimates - Unlevered vs Levered When calculating multiples, it's important to maintain numerator/denominator consistency. Which of the following is not typically considered an appropriate multiple? Share Price / Earnings per Share Market Cap / Sales Enterprise Value / Sales Enterprise Value / EBITDA Screening for Comps - Football Field Chart Review Later Different valuation methodologies will typically result in different valuations. Which of the following valuation methodology usually results in the highest valuation? Precedent transaction analysis Liquidation value Comparable trading analysis Discounted cash flow analysis Enterprise Value vs Equity Value - What is Enterprise Value? Review Later Multiples are calculated using enterprise value or equity value in the numerator. Which of the following is not a proper definition of enterprise value? Equity plus debt minus cash The value of a company's operations Operating assets less operating liabilities Equity minus debt plus cash Debt and Debt Equivalents Review Later Identifying debt and debt equivalents is crucial when valuing a company. Which of the following is considered debt and/or a debt equivalent? Select ALL that apply. An investment in a debt security Operating leases Commercial paper Noncontrolling interest Cash and Non-operating Assets Review Later Identifying cash and non-operating assets is crucial when valuing a company. Which of the following is considered cash and/or a non-operating asset? Select ALL that apply. Assets held for sale Bank deposits Noncontrolling interest Finance leases

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts