Question: Normandy Instruments imvests heavily in research and development ( ( R & D ) ) , aithough it must currently treat its

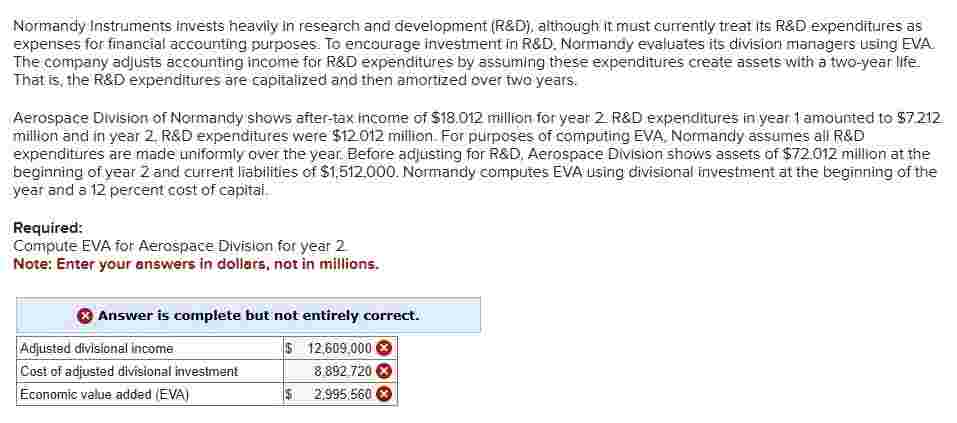

Normandy Instruments imvests heavily in research and development R & D aithough it must currently treat its R&D expenditures as expenses for financial accounting purposes. To encourage investment in R&D Nommandy evaluates its division managers using EVA The company adjusts accounting income for R&D expenditures by assuming these expenditures create assets with a twoyear llfe That is; the R&D expenditures are capitalized and then amortized over two years. Aerospace Division of Normandy shows aftertax micome of $ million for year R&D expenditures in year amounted to $ million and in year R&D expenditures were $ milion. For purposes of computing EVA, Nomandy assumes all R&D expenditures are made uniformly over the year Before adjusting for R&D Aerospace Division shows assets of $ million at the beginning of year and current liabilities of $ Normandy computes EVA using divisional irvestment at the beginning of the year and a percent cost of capital. Required: Compute EVA for Aerospace Division for year Note: Enter your answers in dollars, not in millions. Answer is complete but not entirely correct. Navare Energy Researcin specializes in developing and commercializing new products, It is orgarized into two divisions, wiach are based on the products they produce Canal Division is smaller, and the lives of the products it produces tend to be shorter than those produced by the larger Lake Division. Selected financial data for the past year are shown in the following table Divisional investment is: as of the beginning of the year. Navarre uses an percent cost of capital and beginningoftheyear investment when computing Rol and residual income ignore income taxes.

R & D is assumed to have a threeyear Iffe in Canal Division and an eigthyear life in Lake Division, All R&D expencitures are spent at the beginning of the year. Assume there are no currentllabilities and unrealistically that no R&D investments had taken place before this year.

The manager of the Canal Diviston complains that the calculation of EVA is unfair because a much longer life is assumed for the Lake Division in calculating EVA. The manager of Lake Divisfon responds that EVA is supposed to reflect economic reality and that the reality is that R&D investments in Lake Division do have a longer life.

Required:

a Assume that the economic life of R&D investments is three years in the Canal Division. What economic life would the R&D invesmments in the Lake Division have to make EVA in the two divisions equal?

Note: Do not round intermediate calculations, Round final answer to decimal place. The Street Division of Labrosse Logistics just started operations. It purchased depreciable assets costing $ miliion and having a foutyear expected life, after which the assets can be salvaged for $ mathrmmillion In addition, the division has $ million in assets that are not depreciable. After four years, the division will have $ million avallable from these nondepreciable assets. This means that the divesion has irvested $ million in assets with a salvage value of $ million. Annual operating cash flows are $ million. In computing ROI, this division uses endofyear asset values in the denominator. Depreciation is computed on a straightline basis, recognizing the salvage values noted, ignore taxes.

Assume that the company uses an percent cost of capital.

Required:

a Compute residual income, using net book value for each year.

b Compute residual income, using gross book value for each year.

Note: For all the requirements, enter your answers in thousonds of dollars. Negative amounts should be indicated by a minus sign.

Answer is complete but not entirely correct.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock