Question: Northwest Utility Company faces increasing needs for capital. Fortunately, it has an Aa3 credit rating. The corporate tax rate is 35 percent. Northwests treasurer is

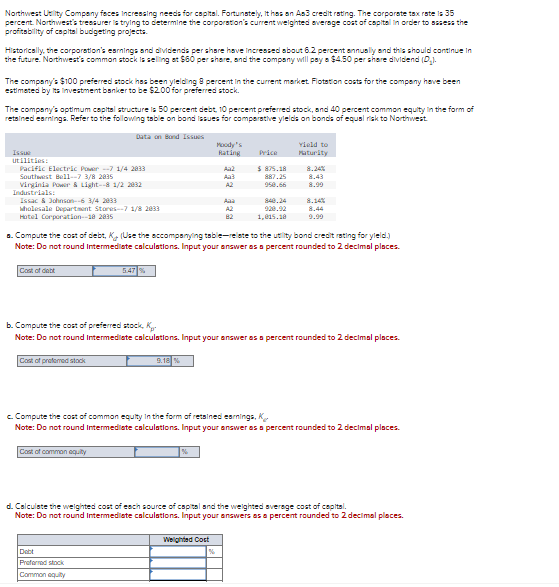

Northwest Utility Company faces increasing needs for capital. Fortunately, it has an Aa3 credit rating. The corporate tax rate is 35 percent. Northwests treasurer is trying to determine the corporations current weighted average cost of capital in order to assess the profitability of capital budgeting projects.

Historically, the corporations earnings and dividends per share have increased about 6.2 percent annually and this should continue in the future. Northwests common stock is selling at $60 per share, and the company will pay a $4.50 per share dividend (D1).

The companys $100 preferred stock has been yielding 8 percent in the current market. Flotation costs for the company have been estimated by its investment banker to be $2.00 for preferred stock.

The companys optimum capital structure is 50 percent debt, 10 percent preferred stock, and 40 percent common equity in the form of retained earnings. Refer to the following table on bond issues for comparative yields on bonds of equal risk to Northwest.

| Data on Bond Issues | |||

| Issue | Moodys Rating | Price | Yield to Maturity |

|---|---|---|---|

| Utilities: | |||

| Pacific Electric Power 7 1/4 2033 | Aa2 | $ 875.18 | 8.24% |

| Southwest Bell7 3/8 2035 | Aa3 | 887.25 | 8.43 |

| Virginia Power & Light8 1/2 2032 | A2 | 950.66 | 8.99 |

| Industrials: | |||

| Issac & Johnson6 3/4 2033 | Aaa | 840.24 | 8.14% |

| Wholesale Department Stores7 1/8 2033 | A2 | 920.92 | 8.44 |

| Hotel Corporation10 2035 | B2 | 1,015.10 | 9.99 |

Compute the cost of debt, Kd. (Use the accompanying tablerelate to the utility bond credit rating for yield.)

Note: Do not round intermediate calculations. Input your answer as a percent rounded to 2 decimal places.

Compute the cost of preferred stock, Kp.

Note: Do not round intermediate calculations. Input your answer as a percent rounded to 2 decimal places.

Compute the cost of common equity in the form of retained earnings, Ke.

Note: Do not round intermediate calculations. Input your answer as a percent rounded to 2 decimal places.

Calculate the weighted cost of each source of capital and the weighted average cost of capital.

Note: Do not round intermediate calculations. Input your answers as a percent rounded to 2 decimal places.

Northwest Ut ity Compony foces incressing needs for captisl. Fortunstely, it has an As 3 credit rsting. The corporste tax rate is 35 percent. Northwest's treosurer is trying to determine the corporston's current weighted oversge cost af coplital in order to sasess the profitsbility of cspltal budgeting projects. Historically, the carporstion's esrnings and diviends per shsre have incressed sbout 6.2 percent ennusly and this should continue in the future. Northwest's common stock is seling ot $60 per shere, and the company will poy a $4.50 per shere dividend (D1). The compsny/s $100 preferred stock has been yielo'ng 9 percent in the current morket. Flotstan costs for the company hove been estimated by tha investment bsaker to be $200 for preferred stock. The compsny's aptimum copital structure is 50 percent debt, 10 percent preferred stock, snd 40 percent common equity in the form of retained esinings. Refer to the folowing tsbie on band lasues far comporstlive yields an bonds of equsl risk to Northwest. a. Compute the cost of debt, Kd (Use the occompsnying tab e-re ate to the ut ity bond erealt rating for yield.) Note: Do not round Intermedlate calculations. Input your answer as a percent rounded to 2 decimal places. b. Compute the cost of preferred stock, Kp. Note: Do not round Intermedlate calculationa. Input your answer as a percent rounded to 2 decimal places. c. Compute the cost of common equity in the form of retsined esmings, Ke. Note: Do not round Intermedlate calculationa. Input your anawer as a percent rounded to 2 decimal places. d. Criculate the weighted cost of eoch source of cspial snd the weighted sverege cost of cepltsi. Note: Do not round Intermedlate calculationa. Input your anawers os a percent rounded to 2 decimal ploces

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts