Question: Norton Company is considering a project that will require an initial investment of $750,000 and will return $200,000 each year for 5- years. Below is

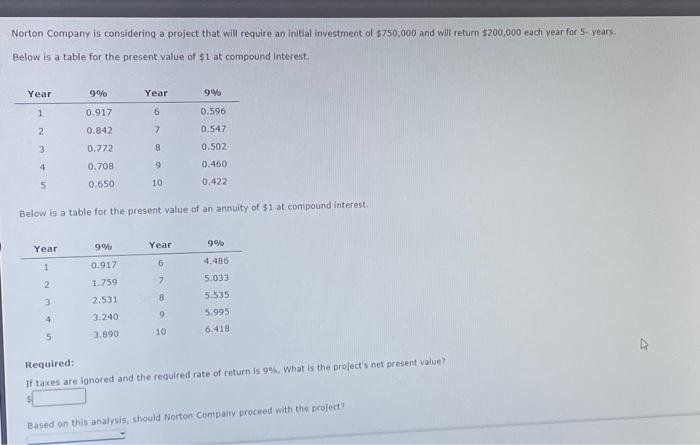

Norton Company is considering a project that will require an initial investment of $750,000 and will return $200,000 each year for 5- years. Below is a table for the present value of $1 at compound interest. Year 1 2 3 4 5 Year 1 2 3 9% 0.917 0.842 0.772 0.708 0.650 4 5 Below is a table for the present value of an annuity of $1 at compound interest. Year 6 9% 0.917 1.759 2.531 3.240 3.890 7 8 9 10 Year 6 9% 7 8 9 10 0.596 0.547 0.502 0.460 0.422 9% 4.486 5.033 5.535 5.995 6.418 Required: If taxes are ignored and the required rate of return is 9%, What is the project's net present value? Based on this analysis, should Norton Company proceed with the project?

Norton Company is considering a project that will require an initial investment of 5750,000 and will retum $200,000 each vear for 5 - years. Below is a table for the present value of $1 at compound interest. Below is a table for the present value of an annuity of $1 at compound interest. If taxes are ignored and the requlred rate of return is 99 , What is the project's net present value? Required: Based on this analysis, should Norten Company proceed with the project

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock