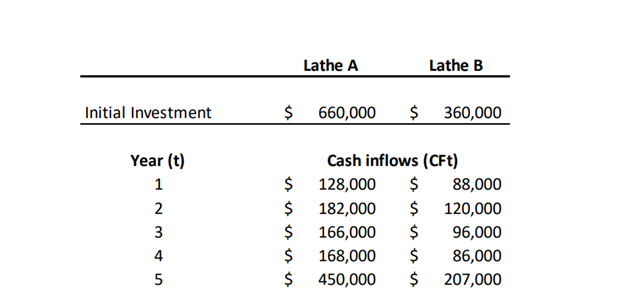

Question: Norwich Tool, a large machine shop, is considering replacing one of its lathes with either of two new lathes lathe A or lathe B .

Norwich Tool, a large machine shop, is considering replacing one of its lathes with either

of two new lathes

lathe A or lathe B

Lathe A is a highly automated, computer

controlled

lathe; lathe B is a less expensive lathe that uses standard technology. To analyse these

alternatives, Mario Jackson, a financial analyst, prepared estimates of the initial

investment and incremental

relevant

cash inflows associated with each lathe. These are

shown in the following table.

Note that Mario plans to analyse both lathes over a

year period. At the end of that time,

the lathes would be sold, thus accounting for the large fifth year cash inflows.

Mario feels the two lathes are equally risky and the acceptance of either of them will not

change the company

s overall risk. He

therefore decided to apply the company

s

cost of capital when analysing the lathes. Norwich Tool requires all projects to have a

maximum payback period of

years

Required:

a

Research the concept of Payback period and calculate the Payback period of both

lathes.

b

Perform a cost benefit analysis and advise Mario which lathe to acquire.

Do support your assumptions for including any item or variable.

Give full explaination to ge marks.

tip: a point listed or an element description is given only one

mark

NB Steps in performing a Cost Benefit Analysis include:

Decide on alternatives to compare

Identify all relevant costs and benefits for the project lifetime

Give monetary values for each

Forecast future costs and benefits

Consider Present Values

Consider nonfinancial costs & benefits

Make a decision

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock