Question: Norwich Tool, a large machine shop, is considering replacing one of its lathes with either of two new lathes--lathe A or lathe B. Lathe A

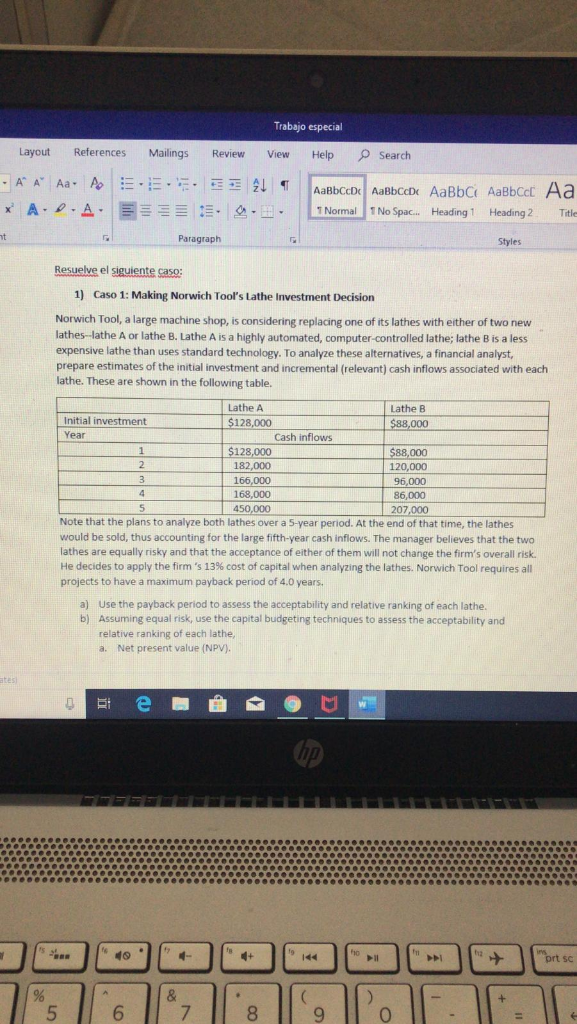

Norwich Tool, a large machine shop, is considering replacing one of its lathes with either of two new lathes--lathe A or lathe B. Lathe A is a highly automated, computer-controlled lathe; lathe B is a less expensive lathe than uses standard technology. To analyze these alternatives, a financial analyst, prepare estimates of the initial investment and incremental (relevant) cash inflows associated with each lathe. These are shown in the following table.

Note that the plans to analyze both lathes over a 5-year period. At the end of that time, the lathes would be sold, thus accounting for the large fifth-year cash inflows. The manager believes that the two lathes are equally risky and that the acceptance of either of them will not change the firms overall risk. He decides to apply the firm s 13% cost of capital when analyzing the lathes. Norwich Tool requires all projects to have a maximum payback period of 4.0 years.

- Use the payback period to assess the acceptability and relative ranking of each lathe.

- Assuming equal risk, use the capital budgeting techniques to assess the acceptability and relative ranking of each lathe,

- Net present value (NPV).

Trabajo especial Layout References Mailings Review View Help Search 1 Normal 1 No Spac... Heading1 Heading2 Title nt Paragraph Resuelve el siguiente saso 1) Caso 1: Making Norwich Tool's Lathe Investment Decision Norwich Tool, a large machine shop, is considering replacing one of its lathes with either of two new lathes-lathe A or lathe B. Lathe A is a highly automated, computer-controlled lathe; lathe B is a less expensive lathe than uses standard technology. To analyze these alternatives, a financial analyst, prepare estimates of the initial investment and incremental (relevant) cash inflows associated with each lathe. These are shown in the following table. Lathe A Lathe B Initial investment 128 Year Cash inflows 128 182,000 120,000 96,000 168,000 86,000 207 Note that the plans to analyze both lathes over a 5-year period. At the end of that time, the lathes would be sold, thus accounting for the large fifth-year cash inflows. The manager believes that the two lathes are equally risky and that the acceptance of either of them will not change the firm's overall risk. He decides to apply the firm's 13% cost of capital when analyzing the lathes. Norwich Tool requires all projects to have a maximum payback period of 4.0 years. a) Use the payback period to assess the acceptability and relative ranking of each lathe. b) Assuming equal risk, use the capital budgeting techniques to assess the acceptability and relative ranking of each lathe, a. Net present value (NPV). no 0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts