Question: NOS 1 e Management - Second X + attempt.php?attempt=462498cmid=28802&page=1 Resize animated GIF G digital marketing New British Council Degree Programs G Good Luck - Googl...

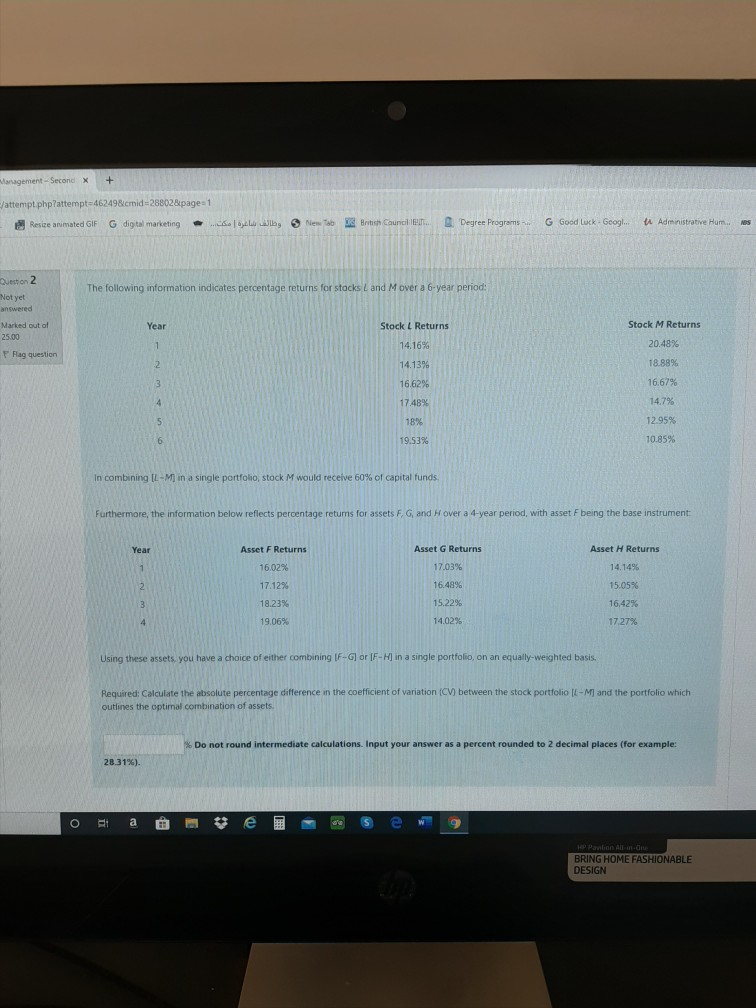

NOS 1 e Management - Second X + attempt.php?attempt=462498cmid=28802&page=1 Resize animated GIF G digital marketing New British Council Degree Programs G Good Luck - Googl... Administrative Hum Question 2 The following information indicates percentage returns for stacks L and Mover a 6-year period: Not yet answered Marked out of Year Stock L Returns Stock M Returns 25.00 14.16% 20.48% F Flag question 2 14.1396 18.88% 3 16.62% 16.67% 4 17.48% 14.7% 5 18% 12.95% 6 19.53% 10.85% In combining IL-M in a single portfolio, stock M would receive 60% of capital funds. Furthermore, the information below reflects percentage returns for assets F, G, and Hover a 4-year period, with asset Fbeing the base instrument Year Asset F Returns Asset G Returns Asset H Returns 1 16.02% 17.03% 14.14% 2 17.12% 16.48% 15.05% 3 18.23% 15.22% 16,42% 4 19.06% 14.029 17.27% Using these assets you have a choice of either combining IF-G] or [F-Hin a single portfolio, on an equally-weighted basis. Required: Calculate the absolute percentage difference in the coefficient of variation (CV) between the stock portfolio IL-M] and the portfolio which outlines the optimal combination of assets. % Do not round intermediate calculations. Input your answer as a percent rounded to 2 decimal places (for example: 28.31%). O a *** HP Pavilion All BRING HOME FASHIONABLE NOS 1 e Management - Second X + attempt.php?attempt=462498cmid=28802&page=1 Resize animated GIF G digital marketing New British Council Degree Programs G Good Luck - Googl... Administrative Hum Question 2 The following information indicates percentage returns for stacks L and Mover a 6-year period: Not yet answered Marked out of Year Stock L Returns Stock M Returns 25.00 14.16% 20.48% F Flag question 2 14.1396 18.88% 3 16.62% 16.67% 4 17.48% 14.7% 5 18% 12.95% 6 19.53% 10.85% In combining IL-M in a single portfolio, stock M would receive 60% of capital funds. Furthermore, the information below reflects percentage returns for assets F, G, and Hover a 4-year period, with asset Fbeing the base instrument Year Asset F Returns Asset G Returns Asset H Returns 1 16.02% 17.03% 14.14% 2 17.12% 16.48% 15.05% 3 18.23% 15.22% 16,42% 4 19.06% 14.029 17.27% Using these assets you have a choice of either combining IF-G] or [F-Hin a single portfolio, on an equally-weighted basis. Required: Calculate the absolute percentage difference in the coefficient of variation (CV) between the stock portfolio IL-M] and the portfolio which outlines the optimal combination of assets. % Do not round intermediate calculations. Input your answer as a percent rounded to 2 decimal places (for example: 28.31%). O a *** HP Pavilion All BRING HOME FASHIONABLE

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts