Question: Not excel Not intermediate round Final interest rate 6 places 7. Consider the following statements about a firm: 1. The debt beta of a firm

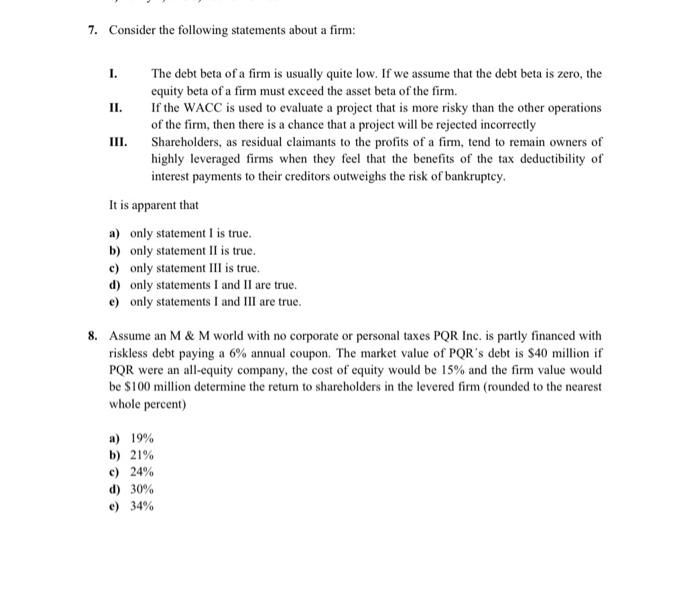

7. Consider the following statements about a firm: 1. The debt beta of a firm is usually quite low. If we assume that the debt beta is zero, the equity beta of a firm must exceed the asset beta of the firm. II. If the WACC is used to evaluate a project that is more risky than the other operations of the firm, then there is a chance that a project will be rejected incorrectly III. Shareholders, as residual claimants to the profits of a firm, tend to remain owners of highly leveraged firms when they feel that the benefits of the tax deductibility of interest payments to their creditors outweighs the risk of bankruptcy. It is apparent that a) only statement I is true b) only statement II is true. c) only statement III is true. d) only statements I and II are true. c) only statements I and III are true. 8. Assume an M & M world with no corporate or personal taxes PQR Inc. is partly financed with riskless debt paying a 6% annual coupon. The market value of POR's debt is $40 million if PQR were an all-equity company, the cost of equity would be 15% and the firm value would be $100 million determine the retum to shareholders in the levered firm (rounded to the nearest whole percent) a) 19% b) 21% c) 24% d) 30% e) 34%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts