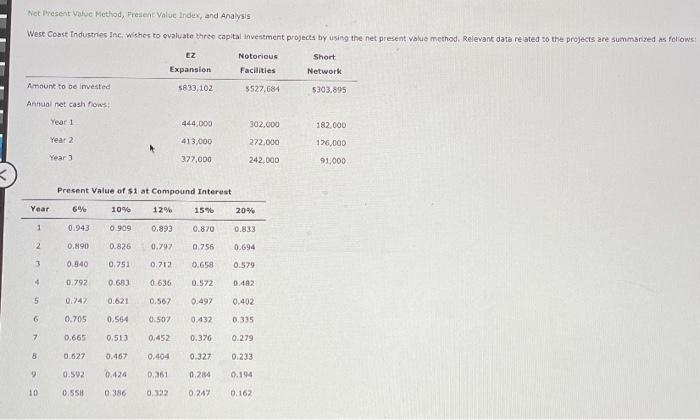

Question: Not Present Value Method, Present Value Index, and Analysis West Coast Industries Inc. Wishes to evaluate three capital investment projects by using the net present

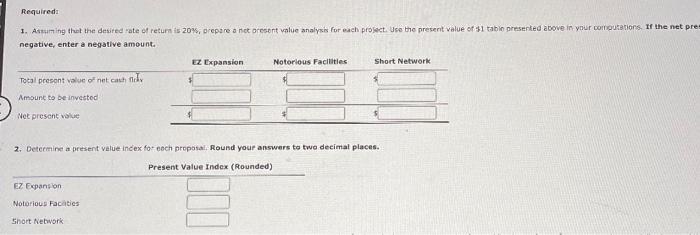

Not Present Value Method, Present Value Index, and Analysis West Coast Industries Inc. Wishes to evaluate three capital investment projects by using the net present Value method. Relevant data reated to the projects are summarized as follows: EZ Notorious Facilities Short Network Expansion Amount to be invested 5833,102 3527,681 $303.895 Annual net cash flows: Year 1 444,000 302.000 182.000 Year 2 413.000 377,000 272.000 242,000 126,000 91.000 Year Present Value of $1 at Compound Interest Year 6% 10% 12% 15% 20% 1 0.943 0.909 0.893 0.870 0.833 2 0.890 0.826 0.797 0.756 0.694 3 0.940 0.751 0.712 0.658 0.579 4 0.792 0.683 0.636 0.572 0.42 5 0.74% 0.621 0.567 0.497 0.402 6 0.705 0.564 0507 0.432 0.335 7 0.665 0.51) 0.452 0.376 0.279 8 0.627 0.467 0.404 0.327 0.233 9 0.592 0.424 0.361 0.284 0.194 10 0.558 0.386 0,332 0.247 0.162 Required: 1. Assuming that the desired rate of return is 20%, prepare a not present value analysis for each project. Use the present value of $1 table presented above in your commutations. If the net pre negative, enter a negative amount. EZ Expansion Notorious Facilities Short Network Total present Value of net cash Amount to be invested Net present value 2. Determine a present value index for each proposal Round your answers to two decimal places. Present Value Index (Rounded) EZ Expansion Notorious Facades Short Network

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts