Question: Not really sure how to do what it is asking. Cornell Tool Manufacturing wants to begin selling a new pair of hand-held pliers in the

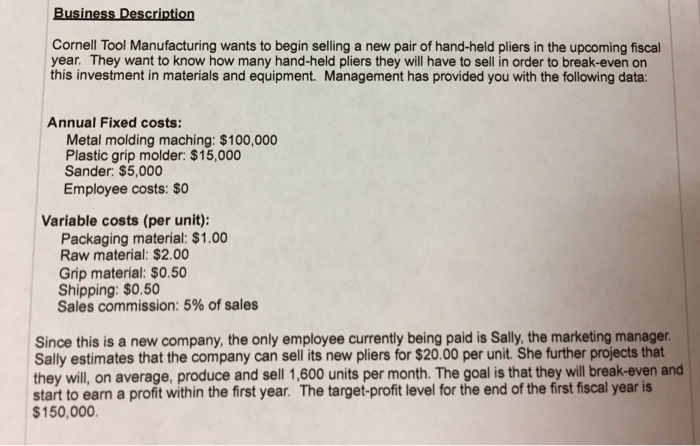

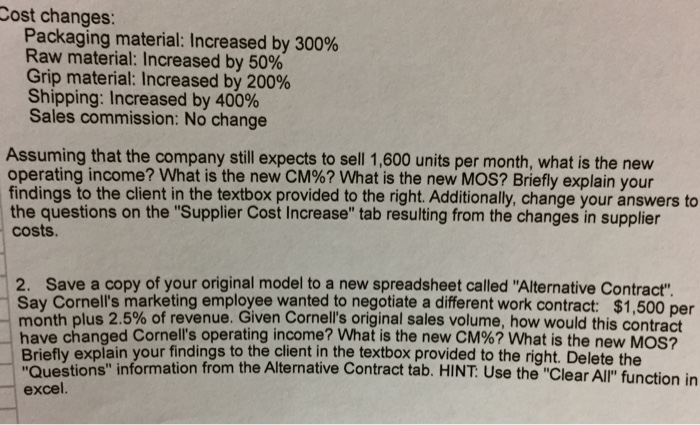

Cornell Tool Manufacturing wants to begin selling a new pair of hand-held pliers in the upcoming fisca year. They want to know how many hand-held pliers they will have to sell in order to break-even on this investment in materials and equipment. Management has provided you with the following data: Annual Fixed costs: Metal molding maching: $100,000 Plastic grip molder: $15,000 Sander: $5,000 Employee costs: $0 Variable costs (per unit): Packaging material: $1.00 Raw material: $2.00 Grip material: $0.50 Shipping: $0.50 Sales commission: 5% of sales Since this is a new company, the only employee currently being paid is Sally, the marketing manager Sally estimates that the company can sell its new pliers for $20.00 per unit. She further projects that they will, on average, produce and sell 1,600 units per month. The goal is that they will break-even and start to earn a profit within the first year. The target-profit level for the end of the first fiscal year is $150,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts