Question: Not sure how it wants me to do the % as it said they were wrong want to check the numbers Pro forma income statement

Not sure how it wants me to do the % as it said they were wrong want to check the numbers

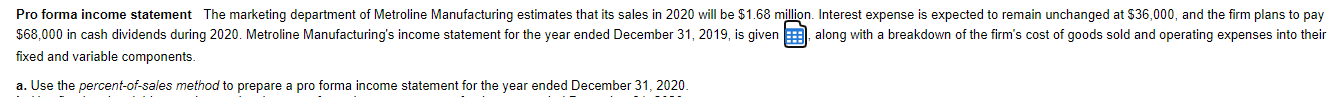

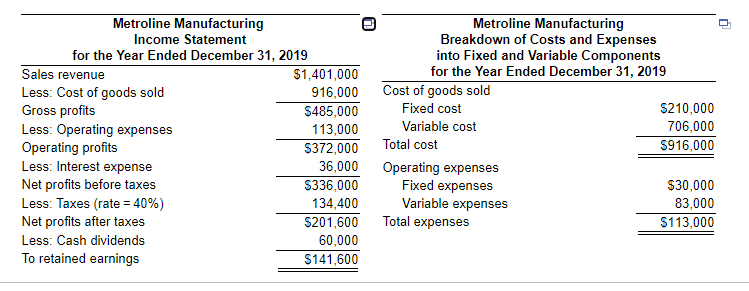

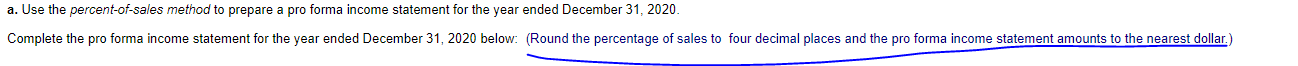

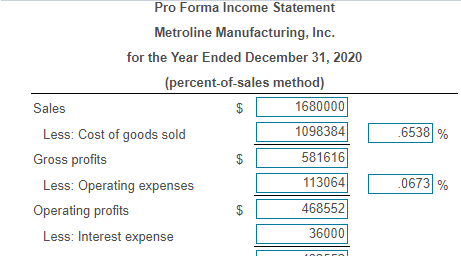

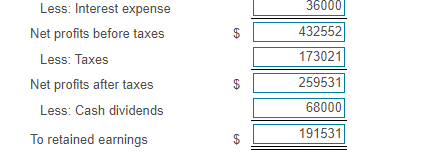

Pro forma income statement The marketing department of Metroline Manufacturing estimates that its sales in 2020 will be $1.68 million. Interest expense is expected to remain unchanged at $36,000, and the firm plans to pay $68,000 in cash dividends during 2020. Metroline Manufacturing's income statement for the year ended December 31, 2019, is given along with a breakdown of the firm's cost of goods sold and operating expenses into their fixed and variable components. a. Use the percent-of-sales method to prepare a pro forma income statement for the year ended December 31, 2020. Metroline Manufacturing Metroline Manufacturing Income Statement Breakdown of Costs and Expenses for the Year Ended December 31, 2019 into Fixed and Variable Components Sales revenue $1,401,000 for the Year Ended December 31, 2019 Less: Cost of goods sold 916,000 Cost of goods sold Gross profits S485,000 Fixed cost $210,000 Less: Operating expenses 113,000 Variable cost 706,000 Operating profits $372,000 Total cost S916,000 Less: Interest expense 36,000 Operating expenses Net profits before taxes $336,000 Fixed expenses $30,000 Less: Taxes (rate = 40%) 134,400 Variable expenses 83,000 Net profits after taxes $201,600 Total expenses $113,000 Less: Cash dividends 60,000 To retained earnings $141,600 a. Use the percent-of-sales method to prepare a pro forma income statement for the year ended December 31, 2020. Complete the pro forma income statement for the year ended December 31, 2020 below: (Round the percentage of sales to four decimal places and the pro forma income statement amounts to the nearest dollar.) Pro Forma Income Statement Metroline Manufacturing, Inc. for the Year Ended December 31, 2020 (percent-of-sales method) Sales $ 1680000 Less: Cost of goods sold 1098384 Gross profits $ 581616 Less: Operating expenses 113064 Operating profits $ 468552 Less: Interest expense 36000 6538 % $ .0673 % 36000 $ 432552 Less: Interest expense Net profits before taxes Less: Taxes Net profits after taxes Less: Cash dividends 173021 259531 68000 To retained earnings $ 191531

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts