Question: Not sure how to complete these different journal entries . 11. Suppose your company has one employee that earns a salary of $6,100 per month

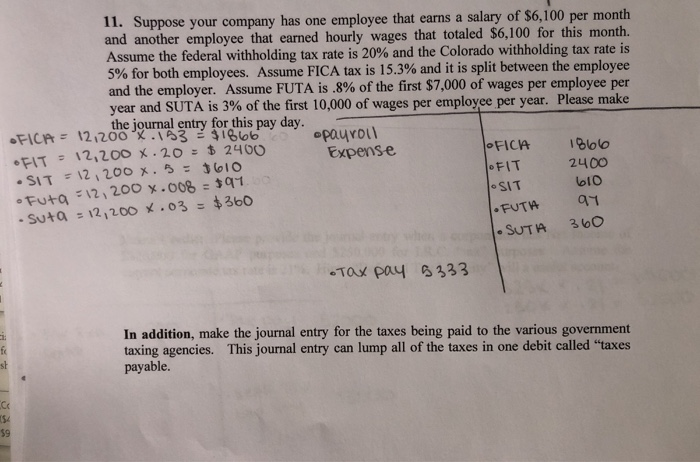

11. Suppose your company has one employee that earns a salary of $6,100 per month and another employee that earned hourly wages that totaled $6,100 for this month. Assume the federal withholding tax rate is 20% and the Colorado withholding tax rate is 5% for both employees. Assume FICA tax is 15.3% and it is split between the employee and the employer. Assume FUTA is .8% of the first $7,000 of wages per employee per year and SUTA is 3% of the first 10,000 of wages per employee per year. Please make the journal entry for this pay day. FICA = 12,200 X .153 $1666 Payroll FIT = 12,200 x 20 = $2400 Expense OFICA 1866 .SIT = 12,200 X.5 = 3610 OFIT 2400 1.SIT 97 futa = 12, 200x.008 = $97. suta = 12, 2008.03 = $360 FUTA SUTA 360 Tax pay 5333 In addition, make the journal entry for the taxes being paid to the various government taxing agencies. This journal entry can lump all of the taxes in one debit called "taxes payable

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts