Question: Not sure how to do it 1. (a) Find a stock that does not pay a dividend. Estimate the price of a 4 or 5

Not sure how to do it

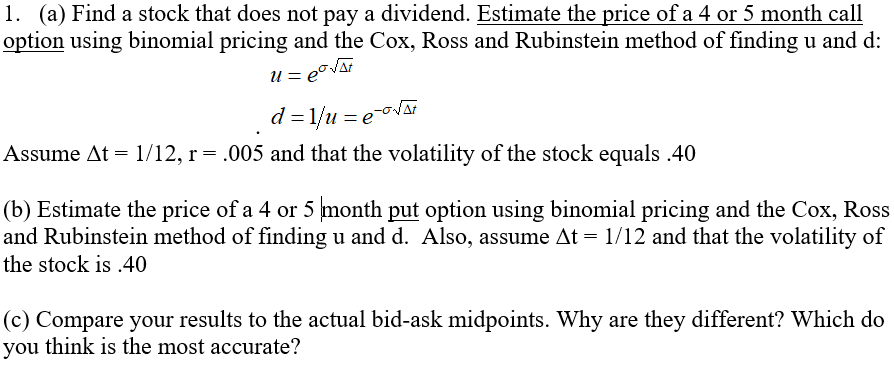

1. (a) Find a stock that does not pay a dividend. Estimate the price of a 4 or 5 month call option using binomial pricing and the Cox, Ross and Rubinstein method of finding u and d: u=porat d = 1/u=e-ova Assume At = 1/12, r= .005 and that the volatility of the stock equals.40 (b) Estimate the price of a 4 or 5 |month put option using binomial pricing and the Cox, Ross and Rubinstein method of finding u and d. Also, assume At= 1/12 and that the volatility of the stock is .40 (c) Compare your results to the actual bid-ask midpoints. Why are they different? Which do you think is the most accurate? 1. (a) Find a stock that does not pay a dividend. Estimate the price of a 4 or 5 month call option using binomial pricing and the Cox, Ross and Rubinstein method of finding u and d: u=porat d = 1/u=e-ova Assume At = 1/12, r= .005 and that the volatility of the stock equals.40 (b) Estimate the price of a 4 or 5 |month put option using binomial pricing and the Cox, Ross and Rubinstein method of finding u and d. Also, assume At= 1/12 and that the volatility of the stock is .40 (c) Compare your results to the actual bid-ask midpoints. Why are they different? Which do you think is the most accurate

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts