Question: not sure how to do this Eric Lu began a small business on 1 July 2018 by depositing $265,000 into a business bank account. On

not sure how to do this

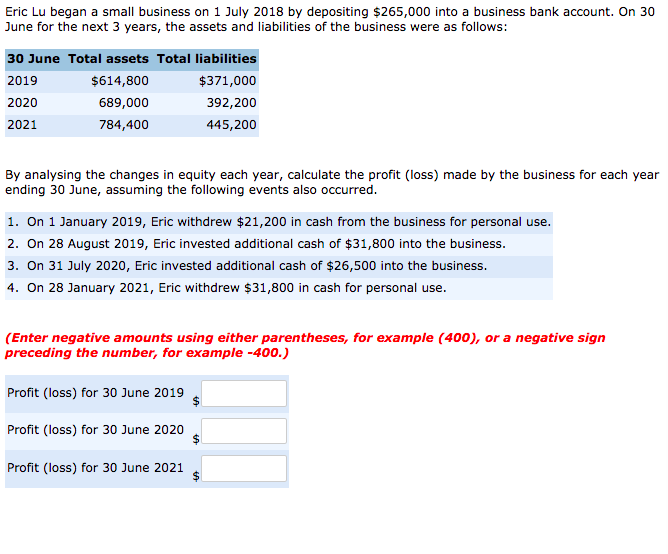

Eric Lu began a small business on 1 July 2018 by depositing $265,000 into a business bank account. On 30 June for the next 3 years, the assets and liabilities of the business were as follows: 30 June Total assets Total liabilities 2019 $614,800 $371,000 2020 689,000 392,200 2021 784,400 445,200 By analysing the changes in equity each year, calculate the profit (loss) made by the business for each year ending 30 June, assuming the following events also occurred. 1. On 1 January 2019, Eric withdrew $21,200 in cash from the business for personal use. 2. On 28 August 2019, Eric invested additional cash of $31,800 into the business. 3. On 31 July 2020, Eric invested additional cash of $26,500 into the business. 4. On 28 January 2021, Eric withdrew $31,800 in cash for personal use. ( Enter negative amounts using either parentheses, for example (400), or a negative sign preceding the number, for example -400.) Profit (loss) for 30 June 2019 Profit (loss) for 30 June 2020 Profit (loss) for 30 June 2021

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts