Question: Not sure how to do (variance for manufacturing overhead) if needed and how to calculate over head costs. Should other expenses be multiplied by the

Not sure how to do (variance for manufacturing overhead) if needed and how to calculate over head costs.

Should "other expenses" be multiplied by the units produced or sold?

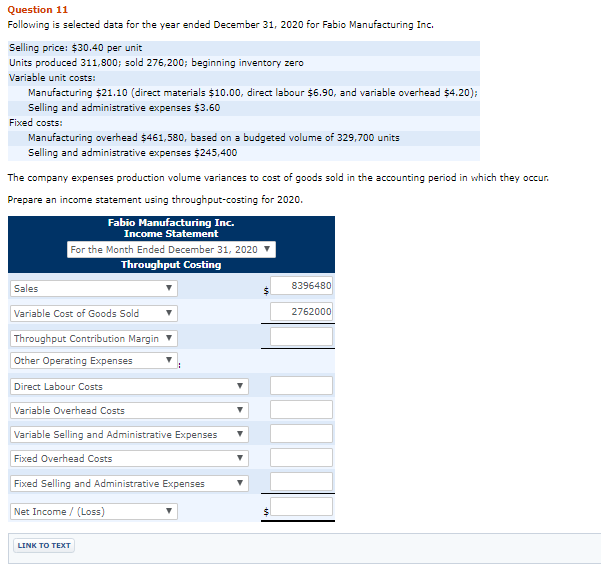

Question 11 Following is selected data for the year ended December 31, 2020 for Fabio Manufacturing Inc. Selling price: $30.40 per unit Units produced 311,800; sold 276,200; beginning inventory zero Variable unit costs: Manufacturing $21.10 (direct materials $10.00, direct labour $6.90, and variable overhead $4.20); Selling and administrative expenses 53.60 Fixed costs: Manufacturing overhead $461,580, based on a budgeted volume of 329,700 units Selling and administrative expenses $245,400 The company expenses production volume variances to cost of goods sold in the accounting period in which they occur. Prepare an income statement using throughput-costing for 2020. Fabio Manufacturing Inc. Income Statement For the Month Ended December 31, 2020 Throughput Costing Sales 8396480 Variable Cost of Goods Sold 2762000 Throughput Contribution Margin Other Operating Expenses Direct Labour Costs Variable Overhead Costs Variable Selling and Administrative Expenses Fixed Overhead Costs Fixed Selling and Administrative Expenses Net Income / (Loss) LINK TO TEXT

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts