Question: Not sure how to journalize this The data needed to determine year-end adjustments are as follows: Depreciation of building for the year, $6, 400. Depreciation

Not sure how to journalize this

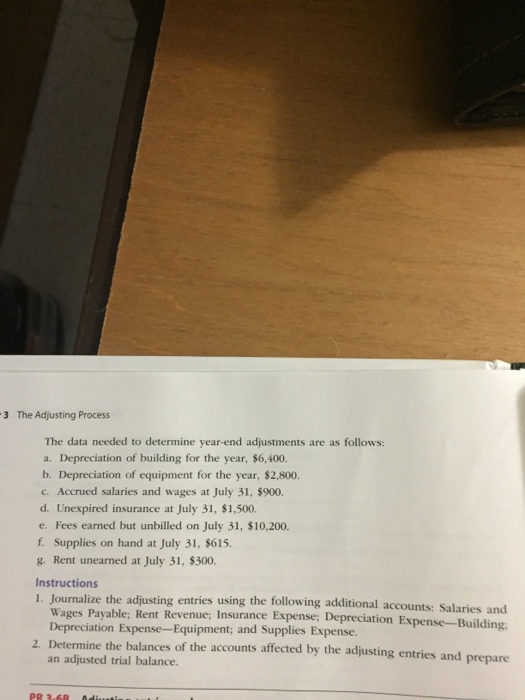

Not sure how to journalize thisThe data needed to determine year-end adjustments are as follows: Depreciation of building for the year, $6, 400. Depreciation of equipment for the year, $2, 800. Accrued salaries and wages at July 31, $900. Unexpired insurance at July 31, $1, 500. Fees earned but unbilled on July 31, $10, 200. Supplies on hand at July 31, $615. Rent unearned at July 31, $300. Journalize the adjusting entries using the following additional accounts: Salaries and Wages Payable; Rent Revenue; Insurance Expense; Depredation Expense-Building; Depreciation Expense-Equipment; and Supplies Expense. Determine the balances of the accounts affected by the adjusting entries and prepare an adjusted trial balance

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts