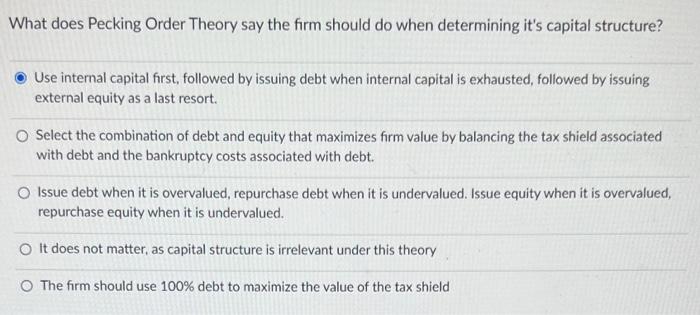

Question: Not sure if answer is right or not. plese double check What does Pecking Order Theory say the firm should do when determining it's capital

What does Pecking Order Theory say the firm should do when determining it's capital structure? Use internal capital first, followed by issuing debt when internal capital is exhausted, followed by issuing external equity as a last resort. Select the combination of debt and equity that maximizes firm value by balancing the tax shield associated with debt and the bankruptcy costs associated with debt. Issue debt when it is overvalued, repurchase debt when it is undervalued. Issue equity when it is overvalued, repurchase equity when it is undervalued. o It does not matter, as capital structure is irrelevant under this theory O The firm should use 100% debt to maximize the value of the tax shield

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts