Question: Not sure if I did first part right. Please answer all parts so I know how to do it. On June 30, year 1, Winson-Arabic,

Not sure if I did first part right. Please answer all parts so I know how to do it.

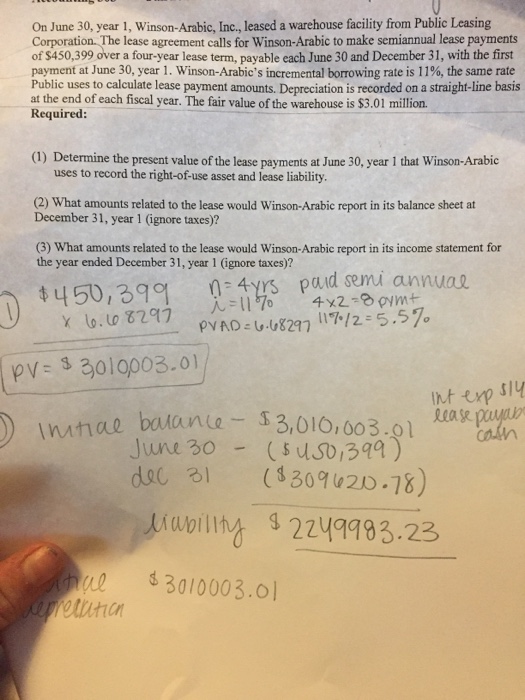

Not sure if I did first part right. Please answer all parts so I know how to do it. On June 30, year 1, Winson-Arabic, Inc., leased a warehouse facility from Public Leasing Corporation. The lease agreement calls for Winson-Arabic to make semiannual lease payments of $450,399 over a four-year lease term, payable each June 30 and December 31, with the first payment at June 30, year 1 . Winson-Arabic's incremental borrowing rate is 1 1%, the same rate Public uses to calculate lease payment amounts. Depreciation is recorded on a straight-line basis at the end of each fiscal year. The fair value of the warehouse is $3.01 million. Required (1) Determine the present value of the lease payments at June 30, year 1 that Winson-Arabic uses to record the right-of-use asset and lease liability (2) What amounts related to the lease would Winson-Arabic report in its balance sheet at December 31, year 1 (ignore taxes)? (3) What amounts related to the lease would Winson-Arabic report in its income statement for the year ended December 31, year 1 (ignore taxes)? 145,3 Pt mrnunn x1o.to'8297 .. 11% 4x2-eovmt pv: 3010003.01 June 30 -s,39) Liwoillhy 223.22 301000 3.01

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts