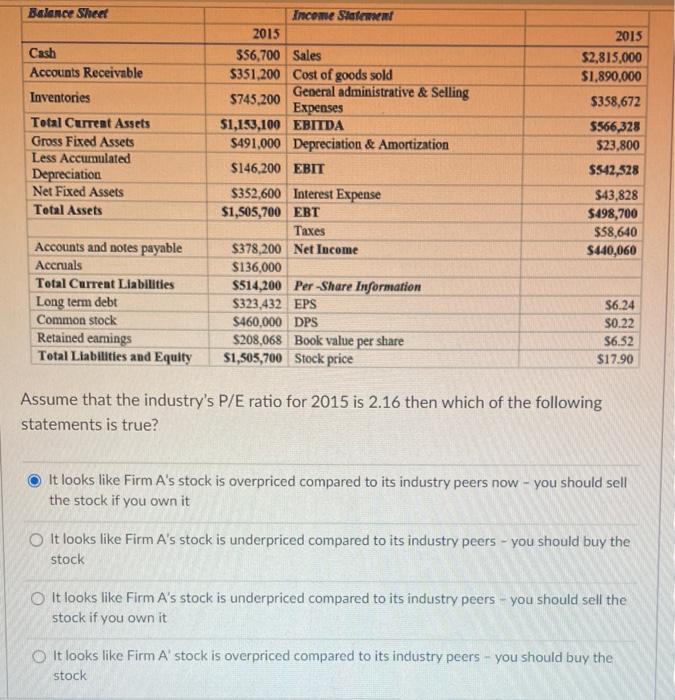

Question: not sure if the correct answer is A or D Balance Sheet Cash Accounts Receivable Inventories Total Current Assets Gross Fixed Assets Less Accumulated Depreciation

Balance Sheet Cash Accounts Receivable Inventories Total Current Assets Gross Fixed Assets Less Accumulated Depreciation Net Fixed Assets Total Assets Income Statem 2015 $56,700 Sales $351,200 Cost of goods sold General administrative & Selling $745.200 Expenses $1,153,100 EBITDA $491,000 Depreciation & Amortization $146,200 EBIT $352,600 Interest Expense $1,505,700 EBT Taxes $378,200 Net Income $136,000 $514,200 Per Share Information $323,432 EPS S460,000 DPS $208,068 Book value per share $1,505,700 Stock price 2015 $2,815,000 S1,890,000 $358,672 5566,328 523,800 5542,528 $43,828 $498,700 $58,640 S440,060 Accounts and notes payable Accruals Total Current Liabilities Long term debt Common stock Retained earings Total Liabilities and Equity $6.24 $0.22 $6.52 $17.90 Assume that the industry's P/E ratio for 2015 is 2.16 then which of the following statements is true? It looks like Firm A's stock is overpriced compared to its industry peers now - you should sell the stock if you own it It looks like Firm A's stock is underpriced compared to its industry peers - you should buy the stock It looks like Firm A's stock is underpriced compared to its industry peers - you should sell the stock if you own it It looks like Firm A' stock is overpriced compared to its industry peers - you should buy the stock

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts