Question: Not sure what I did wrong on this one, please show your work on how you would get your answers. Thank you. Headland Inc. issued

Not sure what I did wrong on this one, please show your work on how you would get your answers. Thank you.

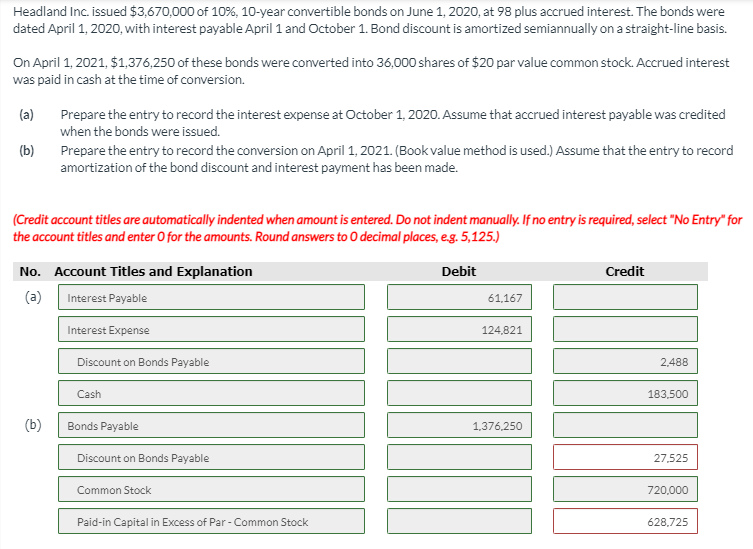

Headland Inc. issued $3,670,000 of 10%, 10-year convertible bonds on June 1, 2020, at 98 plus accrued interest. The bonds were dated April 1, 2020, with interest payable April 1 and October 1. Bond discount is amortized semiannually on a straight-line basis. On April 1, 2021, $1,376,250 of these bonds were converted into 36,000 shares of $20 par value common stock. Accrued interest was paid in cash at the time of conversion. (a) Prepare the entry to record the interest expense at October 1, 2020. Assume that accrued interest payable was credited when the bonds were issued. Prepare the entry to record the conversion on April 1, 2021. (Book value method is used. Assume that the entry to record amortization of the bond discount and interest payment has been made. (b) (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Round answers to decimal places, e.g. 5,125.) No. Account Titles and Explanation Debit Credit Interest Payable 61,167 Interest Expense 124,821 Discount on Bonds Payable 2.488 Cash 183,500 (b) Bonds Payable 1,376,250 Discount on Bonds Payable 27,525 Common Stock 720.000 Paid-in Capital in Excess of Par-Common Stock 628,725

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts