Question: Not sure what information to add.. please be specific on what is needed. Froya Fabrikker A/S of Bergen, Norway, is a small company that manufactures

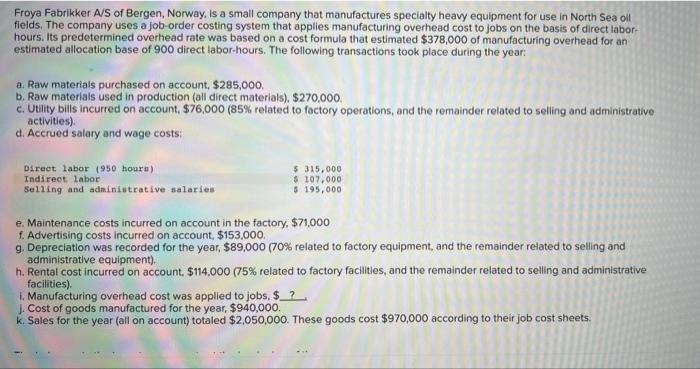

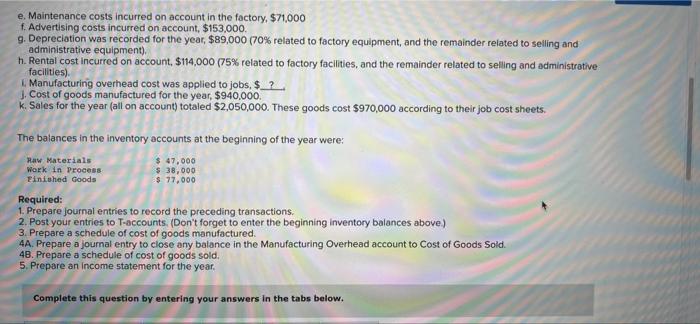

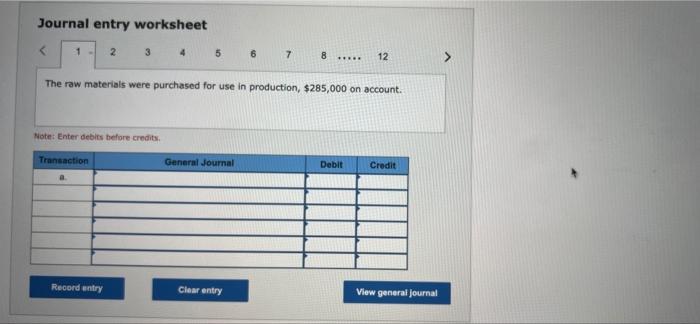

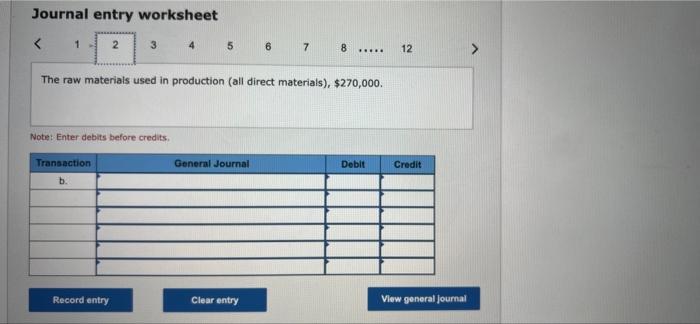

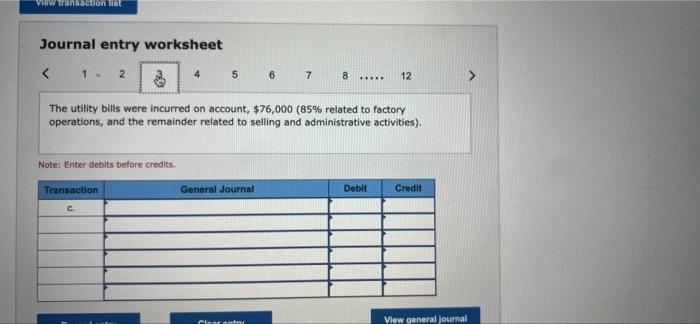

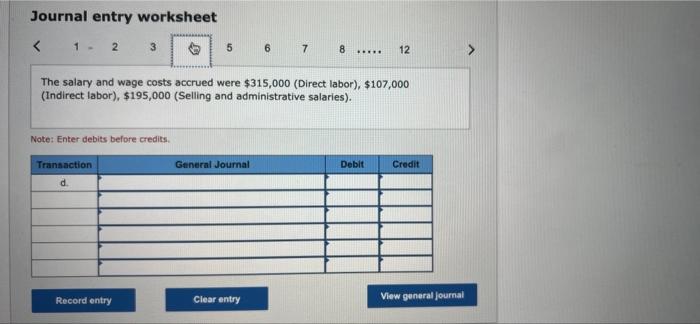

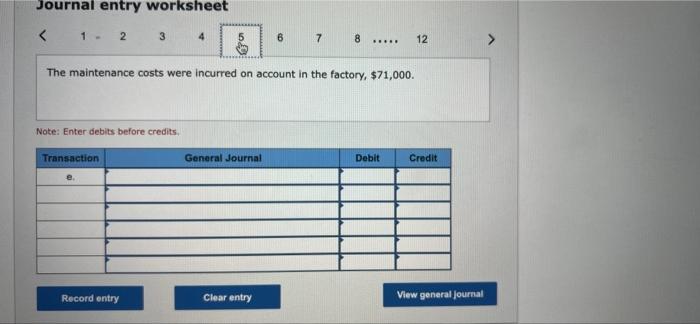

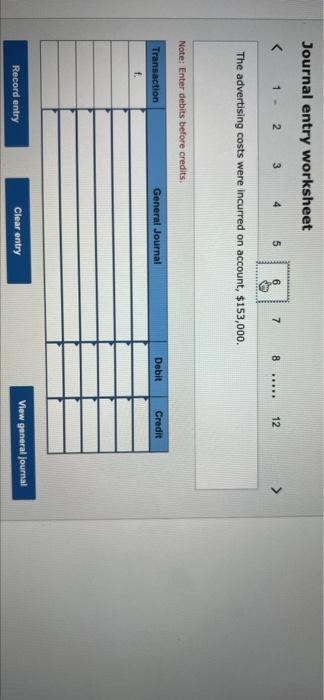

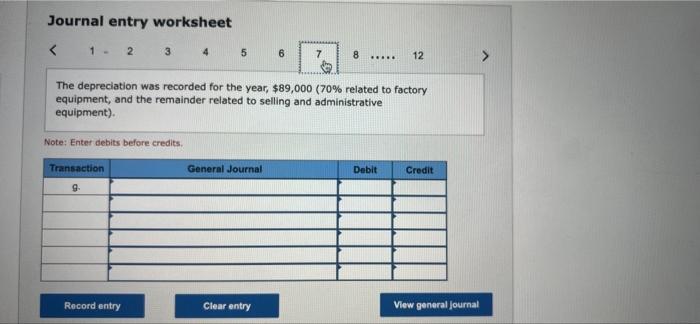

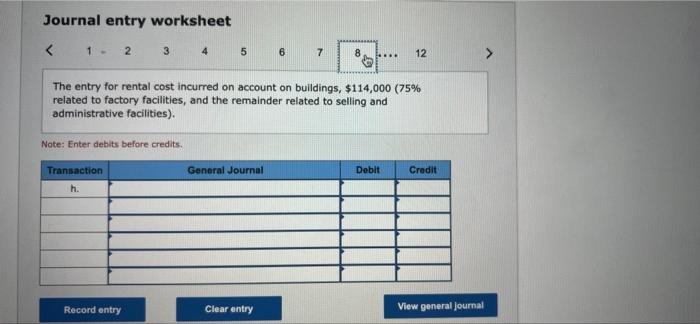

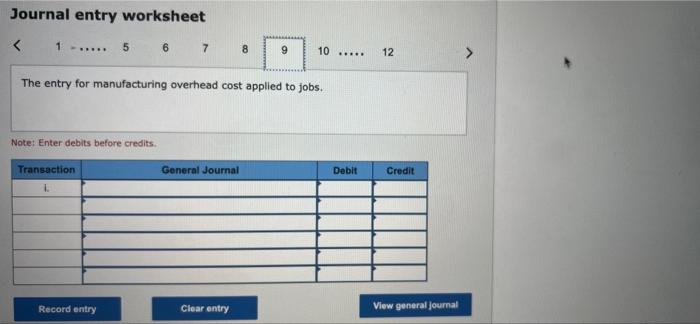

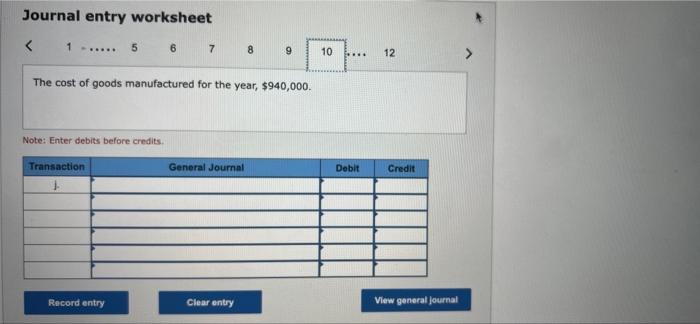

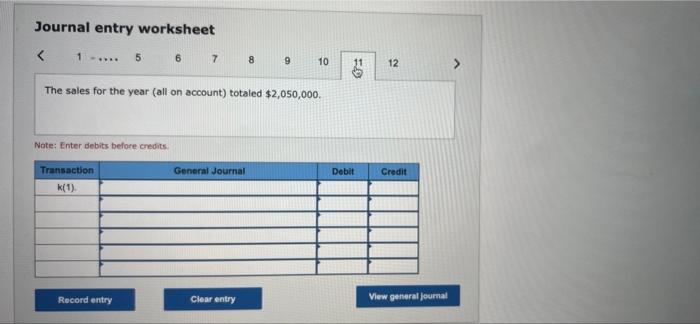

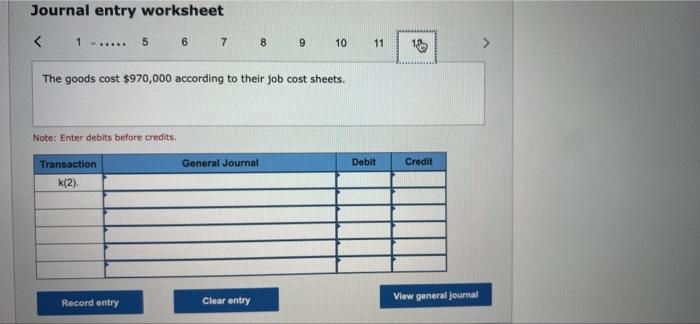

Froya Fabrikker A/S of Bergen, Norway, is a small company that manufactures specialty heavy equipment for use in North Sea oil fields. The company uses a job order costing system that applies manufacturing overhead cost to jobs on the basis of direct labor hours. Its predetermined overhead rate was based on a cost formula that estimated $378,000 of manufacturing overhead for an estimated allocation base of 900 direct labor-hours. The following transactions took place during the year a. Raw materials purchased on account, $285,000. b. Raw materials used in production (all direct materials) $270,000 c. Utility bills incurred on account, $76,000 (85% related to factory operations, and the remainder related to selling and administrative activities) d. Accrued salary and wage costs: Direct labor (950 hours) Indirect labor Selling and administrative salaries $ 315.000 $ 107.000 $ 195,000 e. Maintenance costs incurred on account in the factory, $71,000 f. Advertising costs incurred on account, $153,000 9. Depreciation was recorded for the year, $89,000 (70% related to factory equipment, and the remainder related to selling and administrative equipment). h. Rental cost incurred on account. $114.000 (75% related to factory facilities, and the remainder related to selling and administrative facilities) 1. Manufacturing overhead cost was applied to jobs, $_? J. Cost of goods manufactured for the year. $940,000. k Sales for the year (all on account) totaled $2,050,000. These goods cost $970,000 according to their job cost sheets. e. Maintenance costs incurred on account in the factory, $71,000 f. Advertising costs incurred on account, $153,000. 9. Depreciation was recorded for the year, $89,000 (70% related to factory equipment, and the remainder related to selling and administrative equipment), h. Rental cost incurred on account, $114,000 (75% related to factory facilities, and the remainder related to selling and administrative facilities) Manufacturing overhead cost was applied to jobs. $_2_ J. Cost of goods manufactured for the year, $940,000. k. Sales for the year (all on account) totaled $2,050,000. These goods cost $970,000 according to their job cost sheets. The balances in the inventory accounts at the beginning of the year were: Raw Materials $ 47,000 Work in Process $ 38,000 Finished Goods $ 77.000 Required: 1. Prepare journal entries to record the preceding transactions. 2. Post your entries to T-accounts. (Don't forget to enter the beginning inventory balances above) 3. Prepare a schedule of cost of goods manufactured. 4A. Prepare a journal entry to close any balance in the Manufacturing Overhead account to Cost of Goods Sold. 48. Prepare a schedule of cost of goods sold. 5. Prepare an income statement for the year. Complete this question by entering your answers in the tabs below. Journal entry worksheet 1 2 4 5 6 7 8 12 The raw materials were purchased for use in production, $285,000 on account. Note: Enter debits before credits Transaction General Journal Debit Credit Record entry Clear entry View general Journal Journal entry worksheet

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts