Question: Not sure why the red boxes are appearing wrong, if anyone can clarify this? Thank you (1 pt) At time t-0, Mr. H signs a

Not sure why the red boxes are appearing wrong, if anyone can clarify this? Thank you

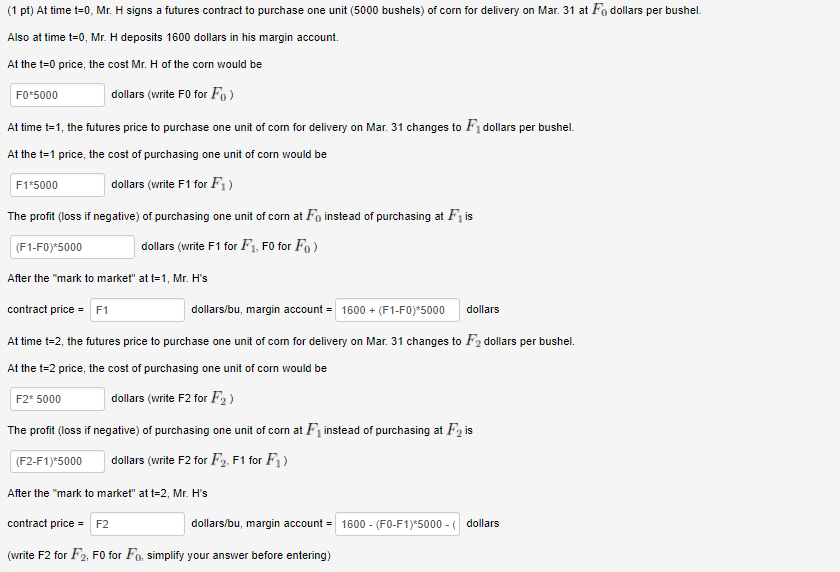

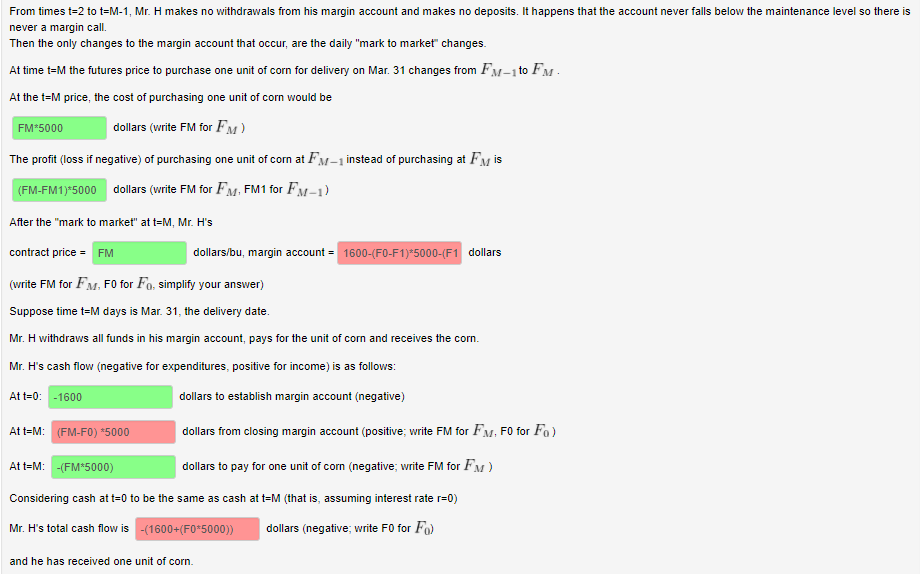

(1 pt) At time t-0, Mr. H signs a futures contract to purchase one unit (5000 bushels) of corn for delivery on Mar. 31 at Fo dollars per bushel Also at time t-0, Mr. H deposits 1600 dollars in his margin account. At the t-0 price, the cost Mr. H of the corn would be Fo 5000dollars (write FO for Fo At time t-1, the futures price to purchase one unit of com for delivery on Mar. 31 changes to F1 dollars per bushel At the t 1 price, the cost of purchasing one unit of corn would be F1 5000dollars (write F1 for F1) The profit (loss if negative) of purchasing one unit of corn at Fo instead of purchasing at Fi is dollars (write F1 for F1, FO for Fo) (F1-FO)*5000 After the "mark to market" at t-1, Mr. H's contract priceF1 At time t-2, the futures price to purchase one unit of com for delivery on Mar. 31 changes to F2 dolars per bushel. At the t 2 price, the cost of purchasing one unit of corn would be F2 5000dollars (write F2 for F2) dollars/bu, margin account1600 (F1-F0) 5000 dollars The prot oss megof uchaing ene unt f cam at Fi mstead f ourchasing (F2-F1) 5000 dollars (write F2 for F2. F1 for F1) After the "mark to market" at t-2, Mr. H's contract priceF2 dollars/bu, margin account1600 - (F0-F1)*5000 dollars (write F2 for F2, FO for Fo. simplify your answer before entering)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts