Question: not using excel 3) You are a financial manager for Shah Corporation. The firm is facing financing issues because of the COVID-19 and has decided

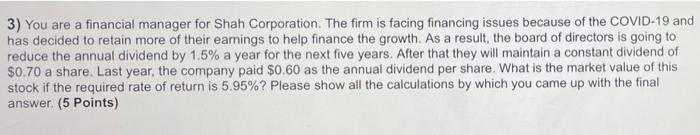

3) You are a financial manager for Shah Corporation. The firm is facing financing issues because of the COVID-19 and has decided to retain more of their earnings to help finance the growth. As a result, the board of directors is going to reduce the annual dividend by 1.5% a year for the next five years. After that they will maintain a constant dividend of $0.70 a share. Last year, the company paid $0.60 as the annual dividend per share. What is the market value of this stock if the required rate of return is 5.95%? Please show all the calculations by which you came up with the final answer (5 Points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts