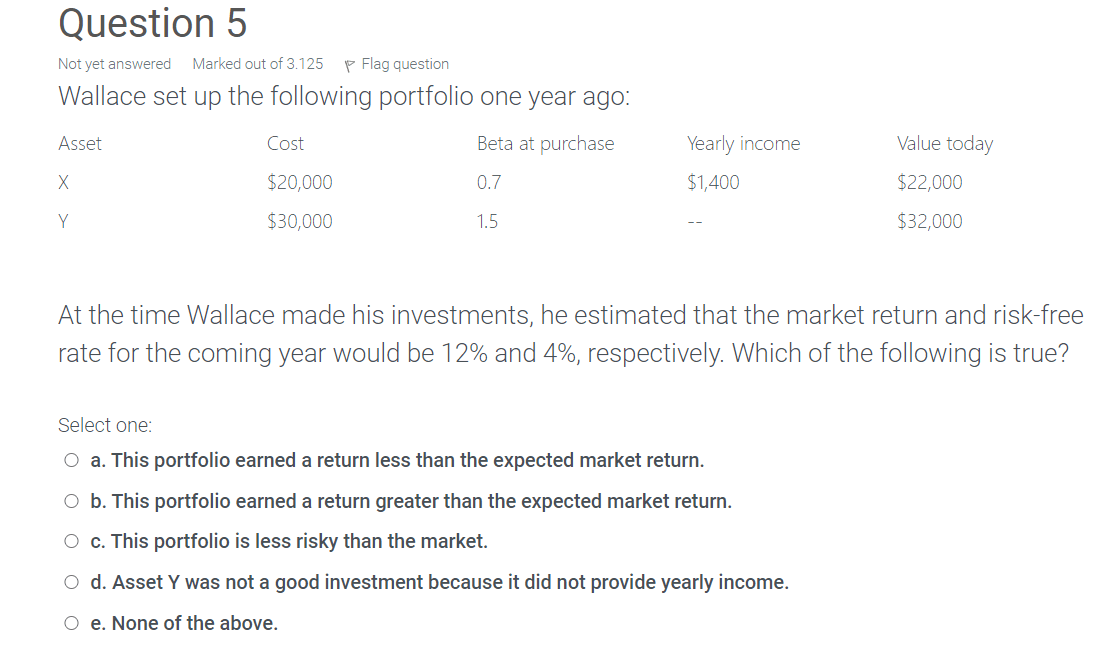

Question: Not yet answered Question 5 Flag question Wallace set up the following portfolio one year ago: Marked out of 3.125 Asset Cost Beta at purchase

Not yet answered Question 5 Flag question Wallace set up the following portfolio one year ago: Marked out of 3.125 Asset Cost Beta at purchase Yearly income Value today X $20,000 0.7 $1,400 $22,000 Y $30,000 1.5 $32,000 At the time Wallace made his investments, he estimated that the market return and risk-free rate for the coming year would be 12% and 4%, respectively. Which of the following is true? Select one: O a. This portfolio earned a return less than the expected market return. o b. This portfolio earned a return greater than the expected market return. O c. This portfolio is less risky than the market. O d. Asset Y was not a good investment because it did not provide yearly income. O e. None of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts