Question: Not yet File Edit View History Bookmarks Develop Window Help Mitc.birzeit.edu Question 8 The BEAR Company has 2000 bonds outstanding that have a market price

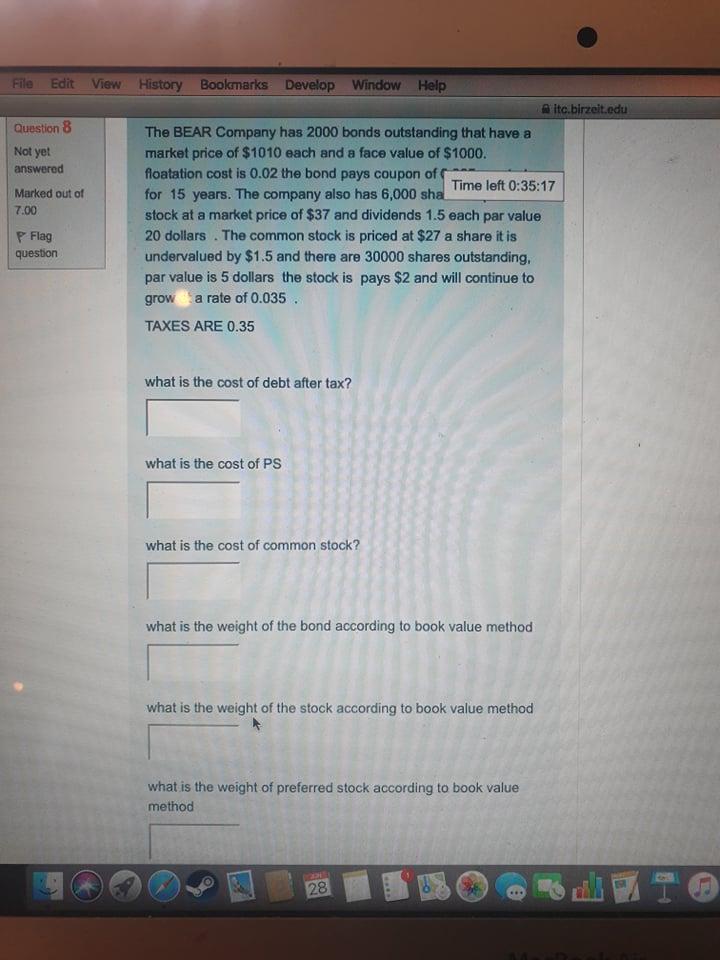

Not yet File Edit View History Bookmarks Develop Window Help Mitc.birzeit.edu Question 8 The BEAR Company has 2000 bonds outstanding that have a market price of $1010 each and a face value of $1000. answered floatation cost is 0.02 the bond pays coupon of Time left 0:35:17 Marked out of for 15 years. The company also has 6,000 sha 7.00 stock at a market price of $37 and dividends 1.5 each par value P Flag 20 dollars. The common stock is priced at $27 a share it is question undervalued by $1.5 and there are 30000 shares outstanding, par value is 5 dollars the stock is pays $2 and will continue to grow a rate of 0.035. TAXES ARE 0.35 what is the cost of debt after tax? what is the cost of PS what is the cost of common stock? what is the weight of the bond according to book value method what is the weight of the stock according to book value method what is the weight of preferred stock according to book value method 28 Not yet File Edit View History Bookmarks Develop Window Help Mitc.birzeit.edu Question 8 The BEAR Company has 2000 bonds outstanding that have a market price of $1010 each and a face value of $1000. answered floatation cost is 0.02 the bond pays coupon of Time left 0:35:17 Marked out of for 15 years. The company also has 6,000 sha 7.00 stock at a market price of $37 and dividends 1.5 each par value P Flag 20 dollars. The common stock is priced at $27 a share it is question undervalued by $1.5 and there are 30000 shares outstanding, par value is 5 dollars the stock is pays $2 and will continue to grow a rate of 0.035. TAXES ARE 0.35 what is the cost of debt after tax? what is the cost of PS what is the cost of common stock? what is the weight of the bond according to book value method what is the weight of the stock according to book value method what is the weight of preferred stock according to book value method 28

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts