Question: Notation : , - . -, , . Question: In its first month of operations, Literacy for the Illiterate opened a new bookstore and bought

Notation : , - . -, , .

Question:

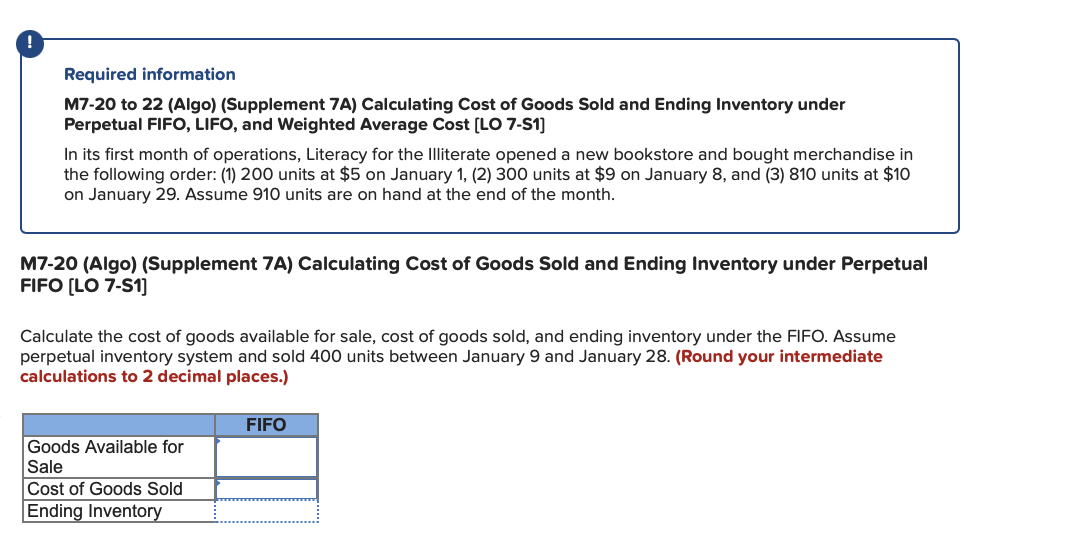

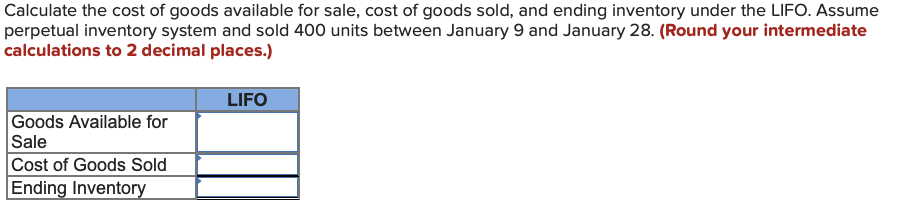

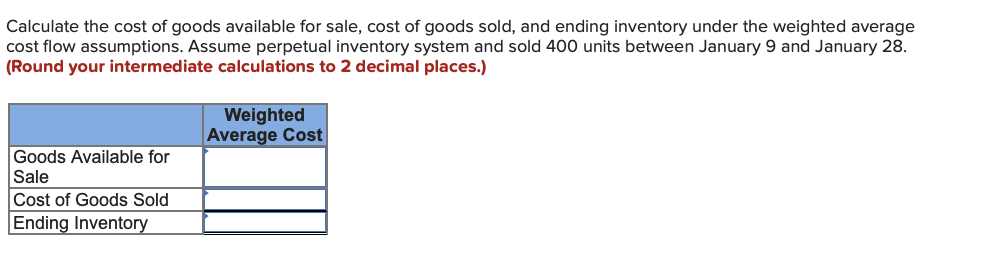

In its first month of operations, Literacy for the Illiterate opened a new bookstore and bought merchandise in the following order: (1) 200 units at $5 on January 1, (2) 300 units at $9 on January 8, and (3) 810 units at $10 on January 29. Assume 910 units are on hand at the end of the month.

Calculate the cost of goods available for sale, cost of goods sold, and ending inventory under the FIFO. Assume perpetual inventory system and sold 400 units between January 9 and January 28. (Round your intermediate calculations to 2 decimal places.)

Please post the steps so I have a better understanding of how to get the answer. I keep getting it incorrect. Thank you so much in advance. I really appreciate it!

Calculate the cost of goods available for sale, cost of goods sold, and ending inventory under the LIFO. Assume serpetual inventory system and sold 400 units between January 9 and January 28 . (Round your intermediate :alculations to 2 decimal places.) Required information M7-20 to 22 (Algo) (Supplement 7A) Calculating Cost of Goods Sold and Ending Inventory under Perpetual FIFO, LIFO, and Weighted Average Cost [LO 7-S1] In its first month of operations, Literacy for the Illiterate opened a new bookstore and bought merchandise in the following order: (1) 200 units at $5 on January 1, (2) 300 units at $9 on January 8, and (3) 810 units at $10 on January 29. Assume 910 units are on hand at the end of the month. M7-20 (Algo) (Supplement 7A) Calculating Cost of Goods Sold and Ending Inventory under Perpetual FIFO [LO 7-S1] Calculate the cost of goods available for sale, cost of goods sold, and ending inventory under the FIFO. Assume perpetual inventory system and sold 400 units between January 9 and January 28. (Round your intermediate calculations to 2 decimal places.) Calculate the cost of goods available for sale, cost of goods sold, and ending inventory under the weighted average cost flow assumptions. Assume perpetual inventory system and sold 400 units between January 9 and January 28. (Round your intermediate calculations to 2 decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts