Question: Note: ( 1 ) , ( 2 ) & ( 3 ) share the same assumptions. ( 1 ) Suppose the simple CAPM is valid

Note: & share the same assumptions.

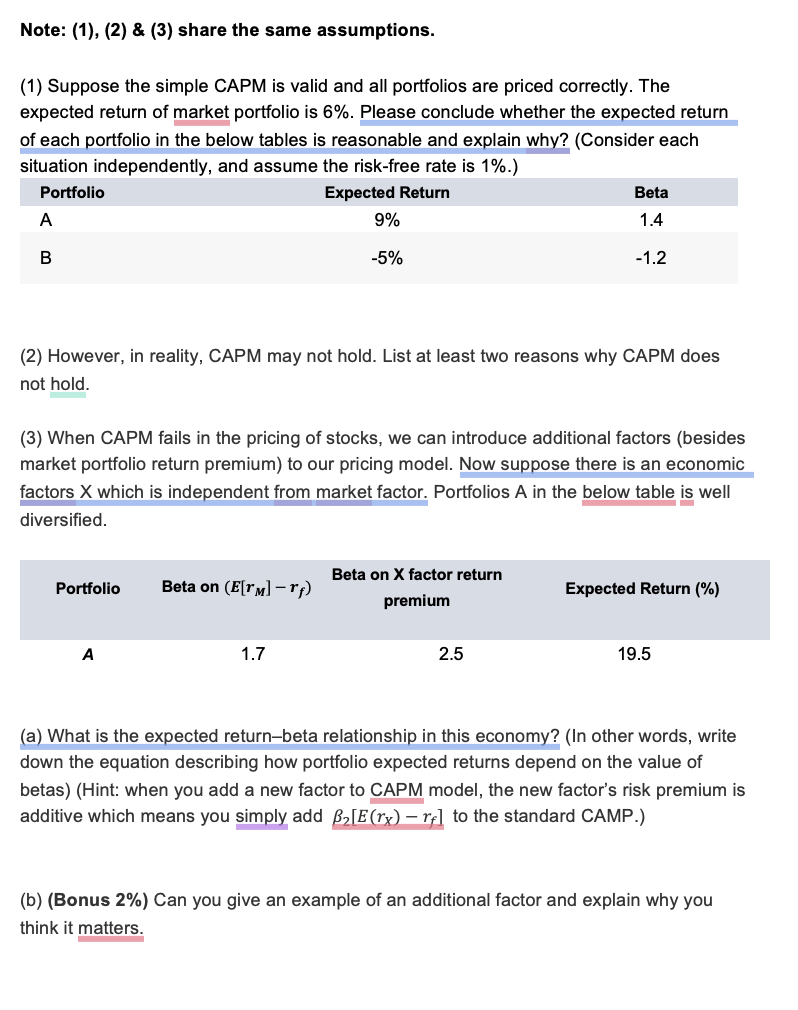

Suppose the simple CAPM is valid and all portfolios are priced correctly. The expected return of market portfolio is Please conclude whether the expected return of each portfolio in the below tables is reasonable and explain why? Consider each

situation independently, and assume the riskfree rate is

However, in reality, CAPM may not hold. List at least two reasons why CAPM does not hold.

When CAPM fails in the pricing of stocks, we can introduce additional factors besides market portfolio return premium to our pricing model. Now suppose there is an economic factors X which is independent from market factor. Portfolios A in the below table is well diversified.

a What is the expected returnbeta relationship in this economy? In other words, write down the equation describing how portfolio expected returns depend on the value of betasHint: when you add a new factor to CAPM model, the new factor's risk premium is additive which means you simply add to the standard CAMP.

b Can you give an example of an additional factor and explain why you think it matters

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock