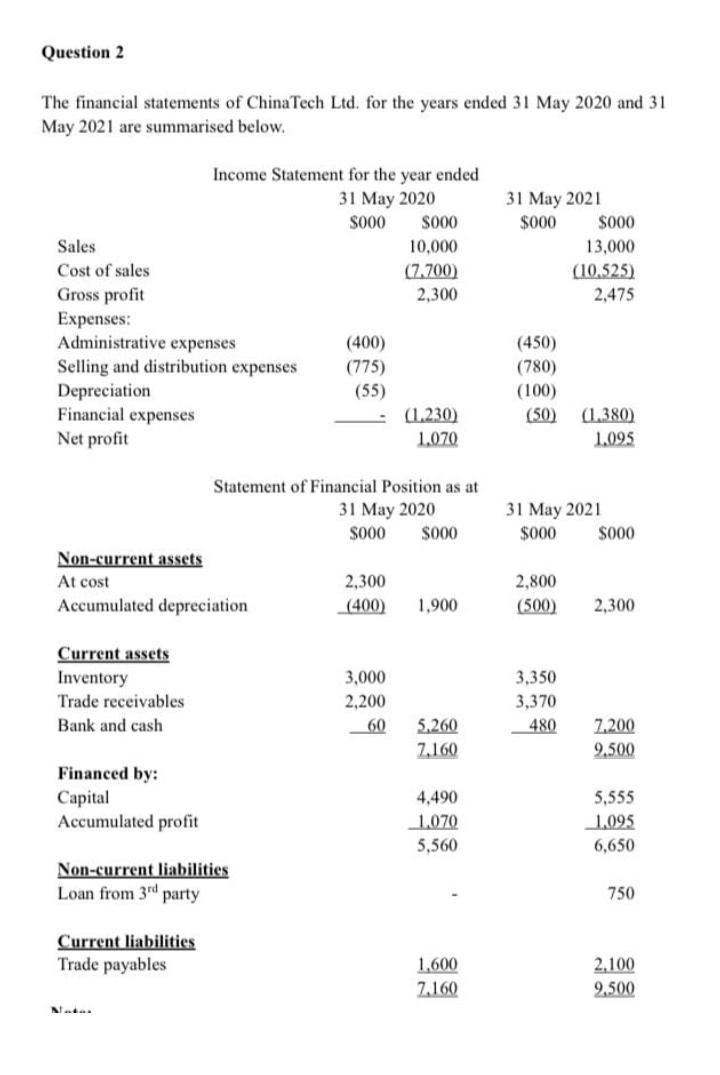

Question: Note: (1) Inventory is valued at $4,000,000 on 1 June 2019. (2) Assume all sales during the period are in credit. REQUIRED (a) Calculate the

Note: (1) Inventory is valued at $4,000,000 on 1 June 2019. (2) Assume all sales during the period are in credit. REQUIRED (a) Calculate the following ratios (rounded to 2 decimal places) for both years. Show your workings clearly. (i) Gross profit percentage (ii) Net profit percentage (iii) Return on capital employed (including long term liabilities) (iv) Inventory turnover (v) Current ratio (vi) Quick ratiol (vii) Trade receivables collection period (in months) (b) comment on the success of the business expansion as indicated by the ratios you have calculated in part (a)

Question 2 The financial statements of China Tech Ltd. for the years ended 31 May 2020 and 31 May 2021 are summarised below. 31 May 2021 $000 S000 13,000 (10.525) 2,475 Income Statement for the year ended 31 May 2020 S000 S000 Sales 10,000 Cost of sales (72700) Gross profit 2,300 Expenses: Administrative expenses (400) Selling and distribution expenses (775) Depreciation (55) Financial expenses (1.230) Net profit 1,070 (450) (780) (100) (50) (1.380 1.095 31 May 2021 $000 S000 Statement of Financial Position as at 31 May 2020 $000 S000 Non-current assets At cost 2,300 Accumulated depreciation (400) 1,900 2,800 (500) 2,300 Current assets Inventory Trade receivables Bank and cash 3,000 2,200 60 3,350 3,370 480 5.260 7.160 7.200 9.500 Financed by: Capital Accumulated profit 4,490 1.070 5,560 5,555 1.095 6,650 Non-current liabilities Loan from 3rd party 750 Current liabilities Trade payables 1.600 7.160 2.100 2.500 N

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts