Question: Note 1: Unless otherwise indicated, all cash flows given in the problems represent after-tax cash flows in current dollars. Note 2: Unless otherwise noted, all

Note 1: Unless otherwise indicated, all cash flows given in the problems represent after-tax cash flows in current dollars. Note 2: Unless otherwise noted, all interest rates presented in this problem set assume annual compounding.

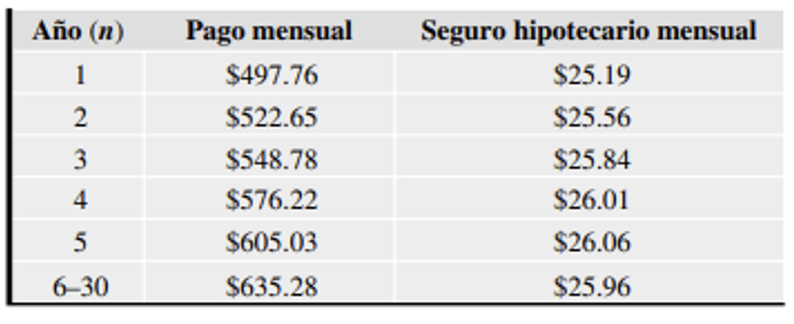

Suppose you are going to buy a $110,000 house, putting $50,000 down. You will pay off the remainder with a loan from Capital Savings and Loan Bank. The officer offers you the following two financing plans for the property: Option 1: A conventional fixed loan with an interest rate of 13% compounded monthly for 30 years with 360 equal monthly payments. A graduated payment schedule (the fha 235 plan) with an interest rate of 11.5% compounded monthly with the following monthly payment schedule: For the fha 235 plan, mortgage insurance is mandatory. a) Calculate the monthly payment for option 1. b) What is the effective annual interest rate you would pay on option 2? c) Calculate the remaining balance for each option at the end of five years. d) Calculate the total interest payment for each option. e) Assuming your only investment alternative is a savings account with an interest rate of 6% compounded monthly, which option represents the best deal?

\begin{tabular}{|c|c|c|} \hline Ao (n) & Pago mensual & Seguro hipotecario mensual \\ \hline 1 & $497.76 & $25.19 \\ 2 & $522.65 & $25.56 \\ 3 & $548.78 & $25.84 \\ 4 & $576.22 & $26.01 \\ \hline 5 & $605.03 & $26.06 \\ \hline 630 & $635.28 & $25.96 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|} \hline Ao (n) & Pago mensual & Seguro hipotecario mensual \\ \hline 1 & $497.76 & $25.19 \\ 2 & $522.65 & $25.56 \\ 3 & $548.78 & $25.84 \\ 4 & $576.22 & $26.01 \\ \hline 5 & $605.03 & $26.06 \\ \hline 630 & $635.28 & $25.96 \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts